With the continuous advancement of the national new infrastructure policy, the digital economy is playing an increasingly important role in the development of the national economy. Emerging technologies such as artificial intelligence, Internet of Things, industrial Internet, and blockchain have become the driving core of the next industrial revolution. Data center, as a key carrier for the integration and application of digital technology and the development of digital economy, has entered a new stage of development.

This article will briefly analyze the development of China's IDC market in the past year from the perspectives of market growth drivers, the impact of policies on the industry, market characteristics and trends.

1. The market scale of traditional IDC business in China is growing rapidly, and public cloud and consumer Internet are the main driving forces for the current development

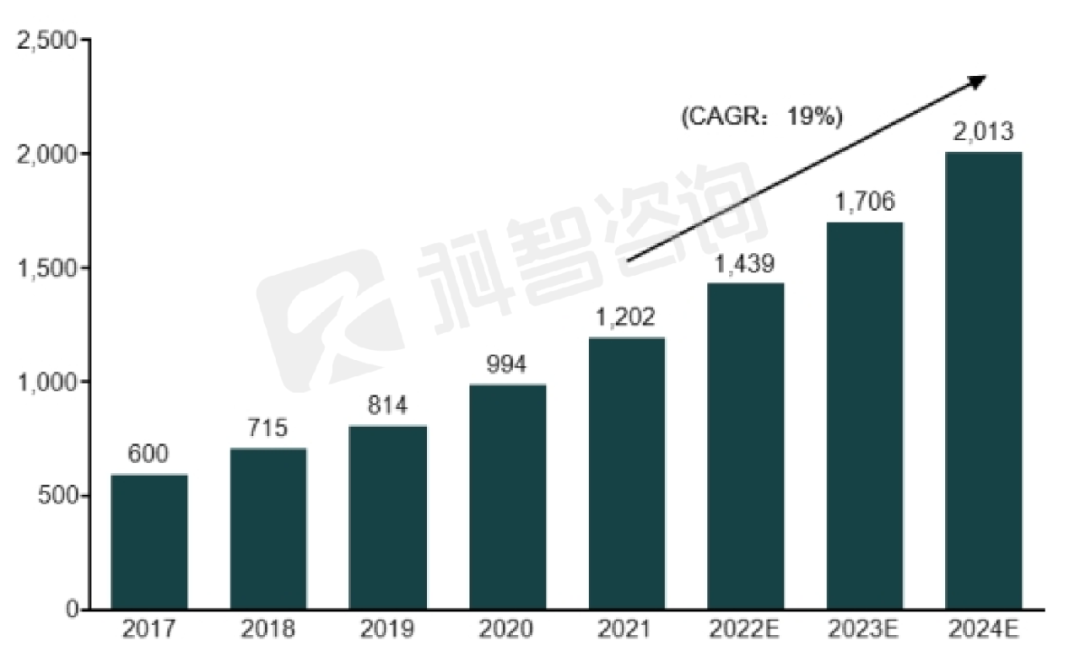

In 2021, the market size of China's traditional IDC business will reach 120.19 billion yuan, a year-on-year increase of 20.9%, maintaining a rapid growth trend. It is estimated that in the next three years, the market size of China's traditional IDC business will continue to grow at a rate of 18.8%, and by 2024, the market size will reach 201.34 billion yuan.

Market size and forecast of traditional IDC business in China from 2017 to 2024 (100 million yuan)

Note: The market scale of traditional IDC services includes business scales such as racks, ports, dedicated lines for equipment rooms, and value-added services.

Data source: KZ Consulting

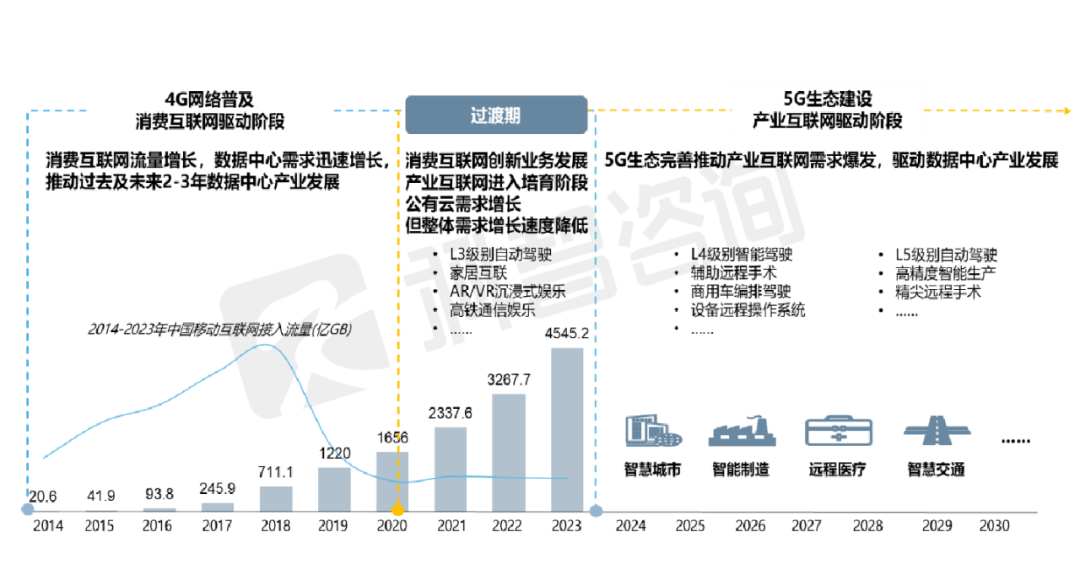

At present, the growth of China's traditional IDC market is mainly driven by the growth of consumer Internet and public cloud businesses. In the future, as the 5G ecosystem matures and emerging technologies are integrated and applied to vertical industries, the development of the industrial Internet will become the main driving factor for the growth of the data center industry.

For a long time, the growth of consumer Internet and public cloud business has generated a large amount of data processing demand, driving the rapid development of the data center industry. In the consumer Internet business, mobile Internet applications such as e-commerce, games, and videos generate a large amount of data processing requirements. Especially in the early stage of development, the average annual growth rate of mobile Internet access traffic exceeds 140%, which promotes the rapid development of the data center industry; In 2010, the demographic dividend of mobile Internet business development gradually disappeared, and the growth rate of access traffic slowed down.

Development drivers and changes of China's traditional IDC industry

Data Source: KZ Consulting

In the future, with the acceleration of 5G construction, the maturity of digital technologies such as AI, the rise of the digital economy as a national strategy, the deep integration of digital technology and vertical industries, and the gradual maturity of application scenarios such as smart cities, financial technology, smart manufacturing, and smart education, which will lead to increased data volume. explosive growth. However, the vertical application of emerging technologies in traditional industries such as manufacturing, finance, and medical care still requires a long incubation period, and will be the first to be applied to the C-side, such as cloud games, 4K/8K video, VR/AR and other related fields.

2. The policies of "new infrastructure", "dual carbon" and "calculation in the east" guide the healthy and sound development of the data center industry

In recent years, the state has intensively introduced relevant policies to regulate the development of the data center industry. Among them, the policies of "new infrastructure", "dual carbon" and "calculation in the east" are the main policy orientations, which will have a significant impact on the development of the industry.

The "New Infrastructure" policy supports the development of the digital economy and drives the growth of the data center industry as a digital infrastructure.

The "New Infrastructure" policy clearly proposes to speed up the construction of new data center infrastructure, guide the rational layout of the industry, and promote the intensive and green high-quality development of the data center industry; at the same time, it supports the development of emerging technologies such as 5G and AI, and promotes the application of new technologies. In traditional fields, new data is generated to drive the development of data centers. After the introduction of the "new infrastructure" policy, the industry's popularity has risen, attracting a large number of cross-border enterprises and capital to enter the market; within the industry, leading data center companies have actively expanded their resources and increased market share through "self-build + mergers and acquisitions". Driven by the "new infrastructure" policy, a large number of planning and construction projects have appeared in the market. Only the number of data center cabinets planned for construction in Beijing, Shanghai, Guangzhou, Shenzhen and surrounding areas has reached one million.

Under the national "dual carbon" policy, as a high energy-consuming industry, data centers need to achieve carbon neutrality by 2030, and the task of green transformation of data centers is urgent.

The government has intensively introduced green development policies, implemented and refined the supervision of energy consumption. In addition to proposing lower PUE limits, energy consumption monitoring has been incorporated into the scope of daily work. At present, Beijing, Shanghai, etc. are actively building and promoting data center energy efficiency online real-time monitoring platforms, requiring real-time monitoring data access platforms for data center computer room energy consumption. Beijing implements a differential electricity price policy and charges data centers with higher PUE levels higher than the average level. The electricity price will be lower, and the data centers with substandard energy consumption and low level of greenness will be upgraded and upgraded. In addition, each major regional market carried out a special campaign for energy evaluation and investigation, strictly enforced the energy-saving review mechanism for data center projects, and supervised and rectified the problems of incompetence evaluation and small energy evaluation. With the continuous advancement of the dual carbon policy, data center energy consumption control and green upgrade will be a long-term task.

All parties in the market are actively exploring the green development path of data centers.

Relevant government departments provide more possibilities for the green transformation of data centers from the policy level, promote the construction of carbon trading rights market, carry out green power trading, guide data center projects to land in areas rich in clean energy and renewable energy, and Encourage companies to publish data center carbon emission reduction footsteps, etc; Data center service providers actively apply energy-saving technologies, purchase green electricity, try to apply renewable energy, and participate in related technology research and development. For example, GDS will sign a green power cooperation framework agreement with China General Nuclear Power New Energy in 2021, and plan to purchase green power from it in the next 10 years, with a total purchase power of no less than 2 billion kWh. Alibaba, Tencent, Baidu and other leading Internet companies have launched carbon emission reduction route planning and practiced the carbon neutrality strategy, which will further promote the carbon neutrality of the entire industry.

The implementation of the "East Data and West Computing" project, based on the future computing power construction and overall planning of the industrial regional layout, will redefine the development of the data center industry and profoundly affect the functional positioning and regional pattern of the data center.

The project of "East Data and Western Computing" requires promoting the layout of data centers from east to west: the eastern hub is mainly positioned at nodes with large service users and strong application needs; the western hub is committed to building a nationwide non-real-time computing power guarantee base. At this stage, China's stock data center cabinets are close to 3 million, about 70% of the resources support the consumer Internet business at the C-end, and the computing resources to support the development of emerging fields are limited. The "East Data and West Computing" project provides computing power support for the whole country by building computing power highlands in major regions of the country, and reserves the underlying resources for the development of emerging fields and the growth of B-side data volume.

In addition, "East and West Calculation" will directly affect the layout of the data center industry. Affected by the limitation of network resources in the development of data centers and the industry attribute of "determining supply according to demand", the development of the data center industry has obvious regional agglomeration characteristics. It takes the lead in developing core cities with high population density, high industrial agglomeration and more developed economy. At this stage, about 70% of the domestic data center resources are concentrated in the eastern region represented by the North, Shanghai, Guangzhou and Shenzhen, followed by the relatively developed regions in Central China, Sichuan and Chongqing, but there are less data center resources in the western region.

Based on the status quo of the industrial layout, the "East Numbers and West Calculations" policy coordinates industrial development across the country, guides data centers to land in "eight nodes and ten cluster areas", and proposes a series of incentive policies and measures such as tax incentives and loan support. Future industrial development will shift to the fields with policy and loan support. In the short term, the western industrial ecology is still in the process of building, and the market demand for computing power has not yet exploded. The market growth will still be concentrated in the core areas of Beijing, Shanghai, Guangzhou and Shenzhen and adjacent clusters; Emerging technologies will be integrated and applied, and the industrial development pattern of "East Data and West Computing" will basically take shape.

3. The contradiction between supply and demand appears, the market is accelerating the integration, and China's IDC market is gradually moving towards a mature stage.

On the whole, China's IDC market is in a stage of transition from a rapid growth period to a mature period, the contradiction between supply and demand appears, and the market is accelerating its integration.

Public cloud and Internet applications are the main source of demand for China's IDC industry, consuming more than 80% of cabinet resources, but the growth rate of demand has slowed down in recent years.

In the consumer Internet business, the mobile Internet contributes most of the data traffic and data processing needs. After 2018, as the demographic dividend gradually disappears, China's mobile Internet tends to be saturated, the growth rate of access traffic has dropped significantly, the emergence of emerging business forms or products may lead to an increase in data traffic in the short term. On the whole, however, the growth rate of consumer Internet demand has slowed down year by year; from the perspective of public cloud business, the development of cloud computing technology has changed the way enterprise IT is deployed. A large number of small and medium-sized enterprises have shifted from independent deployment to cloud deployment. Business development can be achieved by deploying resource pools on a large scale. However, at this stage, public clouds mainly provide IT deployment services for small and medium-sized Internet enterprises, mainly replacing existing demand. Before traditional enterprises achieve a deeper level of digital transformation, the pace of deployment of resource pools in the public cloud will also slow.

In recent years, the average price of IDC cabinets in China has declined to a certain extent, especially between 2020 and 2021, the price in some areas has dropped significantly, showing the characteristics of a buyer's market.

Data center cabinet prices are affected by cost, supply and demand, and the competitive environment: from the perspective of cost, the cost of data center cabinets includes two parts: construction and operation. Data center construction technology tends to mature, and costs are basically stable. Some service providers promote refined operations, and data center operating costs have also decreased slightly. From the perspective of supply and demand, the potential supply of the overall market has grown rapidly, the growth rate of demand has slowed down, and the supply and demand relationship of cabinets in some regions has a short-term imbalance, and the buyer's right to speak in market transactions has increased. From the perspective of competition, the increase in potential supply and the intensification of market competition, especially the adoption of low-price strategies by some service providers to compete for large-granular customers, are the main reasons for the sharp drop in prices in some regions in the past two years.

The high-quality resources of the market are concentrated in the leading data center service providers, and the industry tends to be integrated. The development of market integration is reflected in the tendency of capital flow to concentrate and the flow of high-quality projects to leading service providers.

The entry of capital provides financial support for the development of data center enterprises. Since the new infrastructure construction, the capital has been closely focused on the field of data centers in China, and the number and total amount of investment activities have increased significantly. Funders tend to choose leading data center companies with higher existing market shares and rich data center reserves due to the consideration of financial security and profit space. Judging from the actual market situation, investment institutions such as private equity funds focus on leading companies such as GDS and 21Vianet, which have both current advantages and future development space. Among the investment and financing events above the designated size in China's IDC field, 37% of the investment and financing activities occurred in leading companies; in 34% of the investment and financing events, investment institutions chose Puping Data, Haoyun Network, Haoyang Data, etc. with future development potential data center companies.

Leading data center service providers have obtained a large number of high-quality project resources by virtue of their financial capabilities and strong operational capabilities. In core cities, the scarcity of data center performance indicators has been continuously improved. Newly established and cross-border enterprises have obtained a large number of energy consumption indicators, but lack of understanding of the data center industry, lack of project operation experience, and difficulty in promoting the implementation of projects by their own capabilities. Projects are often withdrawn or acquired by other businesses; The leading data center service providers have both capital and operational capabilities. Through the acquisition of such projects, they can obtain high-quality resources in core cities, such as GDS’ acquisition of Orient Guoxin Data Center in Beijing, and the acquisition of Zituo Technology Longhua Cloud Data Center in Shenzhen, etc.” The "self-build + acquisition" strategy has become one of the important strategic directions of leading companies. Under the influence of the policy of "East and West", cluster areas other than core cities will be the focus of future development, but there are problems such as less demand for landing in the short term, longer periods for projects to achieve steady state operation, and longer periods for capital return. Relying on the advantages of capital capacity and long-term customer accumulation, leading service providers will deploy policy support areas in a forward-looking manner and occupy advantageous resources, which will further promote the integration of the market to the top.

In the future, China's IDC industry will maintain stable growth for a long time. It is expected that after 2024, emerging technologies such as 5G and AI will mature, the industrial Internet ecosystem will gradually form, and the amount of data will increase rapidly, which is expected to promote the IDC industry to enter a new round of growth cycle. From the perspective of industrial operation, with the implementation of the government's standardized policies, the more standardized and reasonable industrial operation mechanism, and the advancement of the refined operation of all parties in the industrial chain, the future industrial development will be more healthy, efficient and sustainable.