Recently, KZ Consulting released the "2020-2021 Nantong Data Center Market Investment Insight Report" and the "2020-2021 Suzhou Data Center Market Investment Insight Report" to provide in-depth insights into the investment environment and development opportunities of the Nantong and Suzhou data center markets, and picture the future development trends and give general market entry suggestions.

In recent years, energy consumption control in Shanghai has become stricter, and there has been a certain degree of mismatch between supply and demand, which has prompted a large amount of demand to shift to neighboring surrounding areas such as Nantong and Suzhou

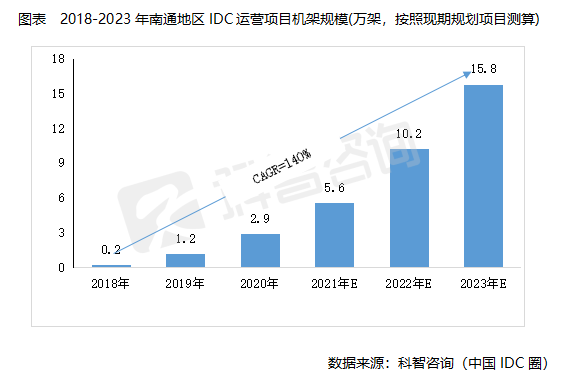

Nantong actively undertakes the needs of Shanghai's Internet and cloud services, develops the data industry, and builds an important information port in East China.

In 2020, the number of data center racks in Nantong will reach 29,000, an increase of 41% compared to 2019. Driven by new infrastructure policies and 5G technologies, the number of cabinets in Nantong will usher in rapid development. It is expected that by 2023, the number of racks in Nantong will reach 158,000.

IDC service providers in Nantong are mainly third parties. In 2020, the proportion of racks resources from third-party service providers in Nantong has exceeded 90%, which is much higher than that of telecom operators (China Unicom, China Mobile, China Telecom). Driven by new infrastructure policies and technologies such as 5G, the market competition for data centers in Nantong has intensified. According to statistics, there are more than 30 data centers under construction and planned in Nantong, and the planned number of cabinets is nearly 200,000. The increase in the number of new cabinets not only meets the needs of a small number of local customers in Nantong, but also mainly undertakes the needs of overseas spillovers in Shanghai and the needs of national industry customers in the East China market.

The major customer groups for new businesses in Nantong have changed, and the demand for Internet and cloud service providers has grown rapidly. In 2020, customer demand in the Internet industry in Nantong will account for nearly 60%, followed by cloud service providers, accounting for nearly 20%.

In the future, as the pace of 5G commercialization accelerates, the growth of big data traffic will become increasingly prominent, and the traditional data center IT architecture will be impacted by more demanding customer needs, which will bring greater challenges to existing data centers and service providers. IDC innovation and investment with a deep understanding of application requirements could benefits the sound development of data center industry.

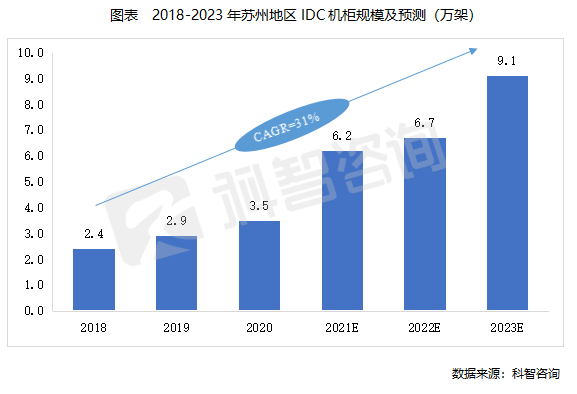

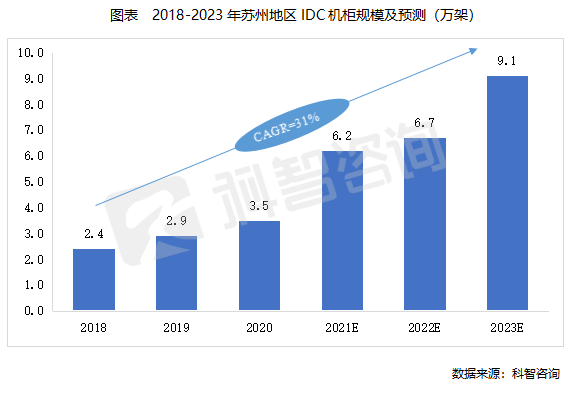

Suzhou is accelerating the construction of data centers to serve the development of local industries and meet the needs of industry customers in Shanghai and East China.

Driven by the new infrastructure and the regional economic integration of the Yangtze River Delta, the Suzhou area has issued a number of policies to encourage the construction of data centers, and actively undertakes Shanghai through regional coordination strategies. In 2020, the data center racks in the Suzhou will reach 35,000, an increase of 21% compared to 2019; in 2021, the third-party service business room such as the 21Vianet Taicang Data Center and the Dr. Peng Taicang Data Center put into operation, which led a rapid growth in racks of Suzhou; it is estimated that by 2023, the total number of IDC operable racks in Suzhou will reach 91,000.

From the perspective of the supply side: the layout of the data center industry in Suzhou shows the characteristics of shifting from the urban area to the surrounding areas, mainly concentrated in Taicang and Kunshan; telecom operators take the route of light capitalization and reduce the amount of data center investment, and the cooperation with third party providers will be further strengthened in the future.

From the demand side: the construction of the Shanghai data center is strictly controlled by the policies. The growth rate of racks resources has gradually slowed down. In addition to meeting the needs of a small number of local customers in Suzhou, the increase in the number of new racks in Suzhou mainly undertakes Shanghai's spillover demand and the needs of industry customers used to lay out other areas of the East China market.

In the future, with the rapid growth of consumer Internet business demand and the gradual release of industrial Internet business demand, large Internet companies represented by Ali, Tencent, and Baidu will deploy regional business nodes in East China. At the same time, local traditional enterprises in Suzhou accelerating the digital transformation of enterprises will also promote the growth of IDC business demand. The data center market in Suzhou will enter a rapid development stage.

This article is for reference only and does not represent any investment advice from us. For relevant information, please refer to the full report.

KZ consulting team has been deeply involved in the IDC industry research field for many years, providing a variety of standardized and customized industry in-depth analysis reports for the industry, including:

2020-2021 Dongguan Data Center Market Investment Insight Report

2020-2021 Foshan Data Center Market Investment Insight Report

2020-2021 China IDC Industry Development Research Report

2020-2021 IDC Market Research Report In Shanghai and Surrounding areas

2020-2021 IDC Market Research Report In Beijing and Surrounding areas

2020-2021 IDC Market Research Report In Guangzhou-Shenzhen Surrounding areas

2020-2021 IDC Market Research Report In Sichuan-Chongqing and Surrounding areas

2020-2021 IDC Market Research Report in Central China

2020-2021 Zhangjiakou Data Center Market Investment Insight Report

2020-2021 Langfang Data Center Market Investment Insight Report

2020-2021 Suzhou Data Center Market Investment Insight Report

2020-2021 Nantong Data Center Market Investment Insight Report

For more information about data center ressearch reports, please contact [email protected]

About IDCNova

IDCNova (Website: www.idcnova.com) is registered under the Hong Kong based Digital Intelligence International Company Limited. As the international presence of Zhongke Zhidao (Beijing) Co Ltd, Ditital Intelligence International aimes at establishing IDCNOVA as a professional media and consulting organization focusing on Internet data center and cloud computing industry, with proactive participation in global emerging markets.

IDCNOVA shares the partent company's unparalleled industry resources and influences in China to track the growth of the ecosystem by delivering news and professional advise on data center in China.

English Website: www.idcnova.com

Wechat Account:

Twitter: @idcnova