Table of Contents

Chapter 1 2020 Global IDC Industry Development Overview 1.1 2020 Global IDC Market Size Analysis

1.2 2020 Global IDC Market Development Features

1.3 Global Key Regions IDC Market Development Overview

Chapter 2 2020 China IDC Industry Development Overview

2.1 China IDC Market Size

2.2 China IDC Market Structure

2.3 China IDC Market Features

Chapter 3 2020 China IDC Industry Development Policy Environment Analysis

3.1 Development of China Data Center Industry Policies

3.2 New Infrastructure Policies

3.3 2020 Data Center Industry Policies

3.4 Digital Industry Policies

Chapter 4 2020 China IDC Industry Supply Analysis

4.1 China IDC Industry Machine Room Layout

4.2 China IDC Industry Machine Room Scale Analysis

4.3 China IDC Industry Technology Development Trend

Chapter 5 2020 China IDC Industry Demand Analysis

5.1 China IDC Industry Customer Demand Overview

5.2 China IDC Market Internet Customer Analysis

5.3 China IDC Market Traditional Industrial Customer Analysis

Chapter 6 2020 China IDC Industry Market Competition Research

6.1 China IDC Service Provider Profile

6.2 China IDC Industry Market Competitive Landscape

6.3 China IDC Service Provider Competition Analysis

6.4 China IDC Industry Market Competition Development

Chapter 7 Future China IDC Industry Development Trend Forecast

7.1 2021-2023 China IDC Business Market Size Forecast

7.2 Future China IDC Industry Supply and Demand Forecast

Chapter 8 2020 China IDC Industry Investment Analysis

8.1 China IDC Industry Investment Scale Analysis

8.2 China IDC Industry Investment Prospect Analysis

8.3 China IDC Industry Investment Opportunities Analysis

8.4 China IDC Industry Investment Risks Analysis

Appendix 1: Glossary

Appendix 2: Report Description

Table of Figures

Figure 1: 2016-2020 Global IDC Market Size and Growth

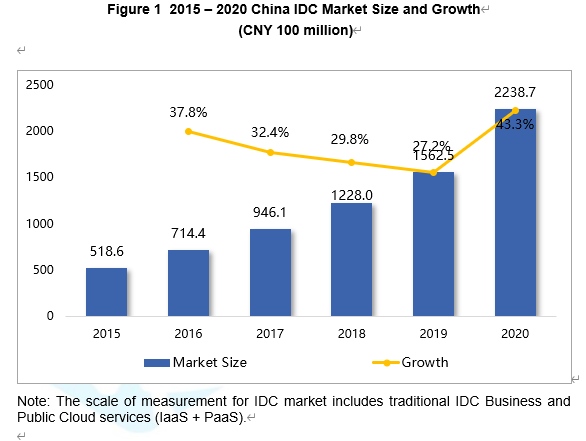

Figure 3: 2015-2020 China IDC Business Market Size and Growth

Figure 4: 2015-2020 China Traditional IDC Business Market Size and Growth

Figure 5: 2019-2020 China IDC Market Structure

Figure 6: 2020 China Traditional IDC Market Structure

Figure 7: 2020 China Third Party IDC Service Providers Value-Added Service Distribution

Figure 10: China 5G Progress and Timeline

Figure 13: the 2020 list of Beijing-Shanghai-Guangzhou-Shenzhen Data Center Projects passed the Opinions on Energy Conservation Review (Partial)

Figure 14: Overview of Newly Built Data Center Project in Tier 2 and Tier 3 Cities of China (Partial)

Figure 15: Distribution of China IDC Machine Rooms under Operation in 2020

Figure 16: List of China Newly Added Large and Super Large Data Centers under Operation from 2018 to 2019

Figure 17: Number of China Large and Super Large Data Centers under Operation from 2018 to 2019

Figure 21: Changes in Edge Data Volume from 2018 to 2025

Figure 22: 2018-2022 China Traditional IDC Business Market Industry Structure and Trends

Figure 23: Differences in the China IDC Industry Customer Selection on Cooperative Service Providers in 2020.

Figure 24: 2020 China IDC Industrial Customers’ Main Considerations when Selecting IDC Service Providers.

Figure 25: 2020 China IDC Market Industry Customer Preferences on Data Center Procurement Mode

Figure 26: Key Considerations for Chinese IDC Industry Customers to Choose IDC Machine Rooms in 2020.

Figure 27: Customer Demand for Value-Added Services in China IDC Industry in 2020

Figure 28: 2020 China Internet Industrial Customer IDC Machine Rooms Demand Features

Figure 29: Video Industry Customers’ Key Considerations on Purchasing IDC in 2020.

Figure 30: Key Considerations of Game Industry Customers’ Key Considerations on Purchasing IDC in 2020.

Figure 31: Demand Features of IDC Machine Rooms for Traditional Industrial Customers in 2020

Figure 33: 2020 China IDC Business Market Third Part Service Providers Competitive Landscape

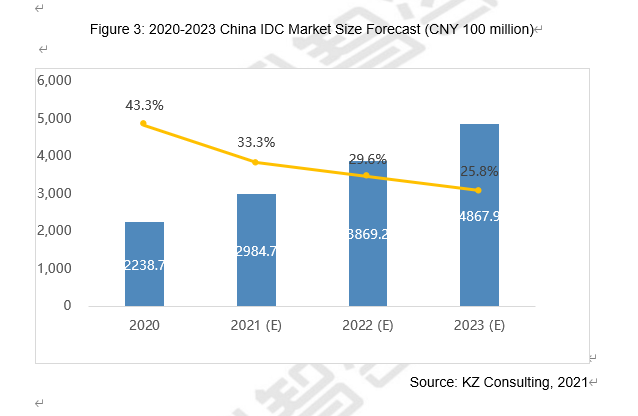

Figure 34: 2020-2023 China IDC Market Scale and Forecast

Figure 35: 2020 - 2022 China Traditional IDC Business Market Size and Growth

Figure 36: China IDC Service Providers Attitude Towards the Demand Growth of Future Internet and Cloud

Figure 37: 2021-2023 Forecast of Top Internet Enterprises New Data Center Demand.

Figure 38: Forecast of China IDC Service Provider Future Demand on the Traditional Segmented Industry IDC

Figure 39: 2018-2023 China IDC Industry Data Center Project Investment Scale and Forecast

Figure 40: 2020 China IDC Industry Data Center Electromechanical Construction Cost Structure

Figure 41: Key Considerations of Enterprises to Invest China IDC Enterprises in 2020

Figure 42: Key Considerations of Enterprises to Invest China IDC Projects in 2020

Figure 43: Investors' Attitudes towards China's IDC Industry Investment Prospects in 2020

Figure 44: Favorable Factors for the Development of Future China IDC Industry

Figure 45: Risks and challenges for the Future China IDC Industry

Figure 48: China IDC Service Providers' Attitudes towards Data Center REITs Policies in 2020

Figure 49: Investors' Attitudes towards Data Center REITs Policies in 2020.

Figure 50: Key Data Center Projects under Planning or Construction in Tier 2 Regional Central Cities (Chengdu, Wuhan) in China

Main Conclusion

In 2020, under the effect of the new infrastructure policy and the national digital transformation development strategy, China IDC industry develops rapidly, and the overall IDC business market growth rate will reach 40%. According to statistics, the market size of Chinese traditional IDC business in 2020 is close to CNY 100 billion, and there is a turning point in industry growth.

In 2020, China overall IDC business market will reach CNY 223.87 billion, a year-on-year increase of 43.3%

In recent years, the emerging technologies is providing technical support and foundation for the digital transformation in various industries; at the same time, the government and industries are actively promoting digital transformation, bringing rapid growth in data volume, and promoting the rapid development of China IDC business market. In 2020, the overall scale of China IDC market will reach CNY 223.87 billion, a year-on-year increase of 43.3%.

Compared with 2019, the growth rate has increased significantly by 16.1%, reaching the highest growth rate in the past five years. The absolute value of the market size has exceeded CNY 200 billion, and more than CNY 67.6 billion increasing than 2019.

The development of IDC business market scale is affected by the two-way influence from the supply side and the demand side. Although China IDC market has been impacted by the epidemic to a certain extent in 2020, the introduction of new infrastructure policies has provided a strong momentum for the development of the data center industry and promoted the construction of many new projects. In general, China data center industry has maintained a rapid development momentum in 2020. From the demand side, the demand of the Internet industry, including public clouds, is the core driving force that drives China IDC business to maintain sustained and rapid growth; During the epidemic, data traffic has increased significantly, promoting the digital transformation of traditional industries, and support the implementation of the new generation information technologies pilot application, such as 5G, AI, and industrial Internet. The demand for the industrial Internet has gradually entered an explosive period.

2. New infrastructure construction policies are supportive to data center industry development.

In March 2020, the Standing Committee meeting of the Political Bureau of the Central Committee clearly proposed to accelerate the progress of new infrastructure construction such as 5G networks and data centers. The data center was included in the category of "new infrastructure", and the development of the data center industry ushered in new major development opportunities. In response to the national new infrastructure policy and support implementation of deployment, Beijing, Shanghai, Guangdong and other provinces and cities across the country have issued new infrastructure development plans to provide strong policy support for the development of the data center industry in various regions.

3 The core cities and surrounding areas form industrial clusters, and Tier 2 and Tier 3 cities have more development opportunities.

Due to the geographical characteristics of network and other supporting resources and IDC demand, China data center industry has formed three major industrial clusters, which are the Beijing-Tianjin-Hebei region, the Yangtze River Delta, and the Greater Bay Area. In recent years, supporting resources in the core cities of Beijing, Shanghai, Guangzhou and Shenzhen have become tighter and PUE restrictions have become increasingly stringent. The development of the data center industry in major core cities is almost saturated, and various regions have actively coordinated to help the regional data center industry development and plan the industry layout properly. They will move ‘warm data’ and ‘cold data’ business to surrounding areas.

The data center industry in Tier 2 cities, such as Chengdu and Wuhan, is still in the development stage. Driven by regional economic development, some new data center projects have been landed, which is showing the potential development trend. With the in-depth advancement of new infrastructure policies and the development of regionally integrated economies, the popularity of the data center market in Tier 2 and Tier 3 cities is rising.

Figure 2: Newly Built Data Center Projects in Tier 2 and Tier 3 Cities of China

City | Service Provider | Name | Planned Racks | Introduction |

Chengdu | Bo Hao (博浩) | China Unicom (Sichuan) Dayi Mintian Data Center | 20,000 | Data Center Planned Area: 150,000 m2 Rack under Operation: 600 |

China Telecom (Chengdu)(成都电信) | Jian Yang Data Center | 9,700 | It will be constructed in two phases, and start operation in 2022. | |

TRS (拓尔思) | Western Regional Headquarter and Big Data R&D and Operation Service Base | 3,000 | Data Center Planned Area: 15,000m2 The data center construction is expected to be completed in 2021. | |

China Mobile (Chengdu)(成都移动) | Wuhou West Smart Valley Data Center | 1,000 | Under construction | |

China Telecom (Chengdu)(成都电信) | Tianfu Cloud Computing Center | --- | There are two phases. The first phase has been delivered and the main customers includes Bank of Chengdu, Qimingxing (启明星), etc. | |

Wuhan | China Finance Data (中金数据) | China Finance Data Wuhan Shu Gu Big Data Center | 25,000 | It is planned to start operation in 2021. |

Tenglong Holding Group (腾龙数据) | Tenglong Guanggu Data Center | 13,000 | It will be constructed in two phases, and it is planned to start operation in 2021. |

4. Traditional IDC companies have accelerated their expansion, cross-industry companies have entered, and competition in the data center market has intensified.

Leading third-party IDC service providers such as GDS have strong market influence and financing capabilities.

They adopted the model of "self-construction + mergers and acquisitions" to rapidly expand IDC business, seize advantageous resources, and gradually expand the competitive advantages of leading companies.

The increasing popularity of the data center market has attracted many companies to enter the data center market to expand and explore new business segments. Based on the attributes of heavy assets and high energy consumption in the data center industry, new entrants can be roughly divided into three categories: First, steel companies with their own power resources, such as Baosteel's investment in the construction of Baozhiyun Data Center, and China Southern Power Grid is planning to construct the Greater Bay Area Digital industry base project, Three Gorges Group invested in the construction of the Dongyue Temple Data Center; Second, industrial funds and state-owned funds with a certain capital scale. With the abundant capital, actively invest in the field of data centers; Third, companies with land resources, such as Southern Logistics Group, Jinmao Green Construction, etc. The companies with various resources advantages entered data center market, which intensified the market competition.

5. Consumer Internet companies are still the main demanders at present, and industrial Internet demand will be gradually released in the future.

In the short term, the demand of the data center market will be still from the leading internet companies, and the rapid growth of public cloud services is the most important driver of demand. The demand for data centers in traditional industries has grown steadily, but the demand of data centers driven by digital policies has not yet been effectively released, and the overall proportion has declined.

At present, the new generation of digital technologies such as 5G and AI have begun to be integrated with the different industries and gradually be applied in the industries. Industries development like smart cities, financial technology, smart manufacturing, smart education will accelerate. According to the process of 5G entering the commercial promotion period from 2020 to 2024, it is expected that the industrial Internet demand brought by the digital transformation of traditional industries will be released in the middle of the future.

6. The state has launched a pilot policy for REITs, and asset securitization will help the industry absorb more investment funds.

In April 2020, the National Development and Reform Commission and the China Securities Regulatory Commission issued the "Notice on Promoting the Pilot Work of Real Estate Investment Trust Funds (REITs) for the Infrastructure Sector" to encourage to launch pilot projects of REITs in the key regions and key industries to revitalize existing assets, widely mobilize the enthusiasm of various social capitals, and promote the high-quality development of infrastructure including data centers.

The introduction of the data center REITs policy has effectively broadened the investment and financing channels of the industry, provided new options for capital exit, and a higher rate of return, which is conducive to further absorbing investment funds in the IDC market.

7 In the future, the size of China IDC market will continue to grow rapidly.

According to KZ Consulting, China IDC market will reach CNY 486.79 billion by 2023 with a CAGR of 29.6%.

Company Mentioned

China Telecom 中国电信

China Unicom 中国联通

China Mobile 中国移动

GDS 万国数据

21Vianet世纪互联

Sinnet 光环新网

Chindata Group秦淮数据

KEHUA DATA科华数据

Forest Eternal 森华易腾

Dr. Peng 鹏博士

Range Technology 润泽科技

AtHub 数据港

CEICLOUD 中经云

ChinaCache蓝汛

NETNIC企商在线

CloudVSP天地祥云

Daily Tech 德利迅达

Yuntai Hulian (transliterated from 云泰互联)

2020-2021 China IDC Market Research Report

Pages: 101

Word Count: 44,900 +

Figure/Table: 51

Price:

Chinese Digital Version: USD 2,000.00

English Digital Version: USD 35,00.00

Chinese and English Version: USD 4,000.00

中科智道國際有限公司

Digital Intelligence International Company Limited

Explore Data Center and Cloud Computing Future

We are Here to Connect China and the World

English Website: www.idcnova.com

Chinese Website: www.idcquan.com

LinkedIn: IDCNOVA

Email Address: [email protected]