In recent years, the contribution of the global digital economy to the economy has continued to increase, and the demand for data storage, analysis, and processing has grown rapidly, driving the rapid development of the global data center market. The mature data center markets in North America, Western Europe, and East Asia continue to develop, and markets such as Southeast Asia and southern Africa gradually strengthen policy support and industrial investment in data centers. The global data center market will enter a new stage of development.

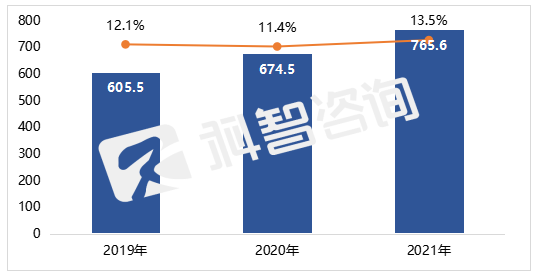

In 2021, the global data center market will reach US$76.56 billion, a year-on-year increase of 13.5%, more than twice the GDP growth rate of the same period, and it is expected to maintain a growth rate of more than 10% in the next few years.

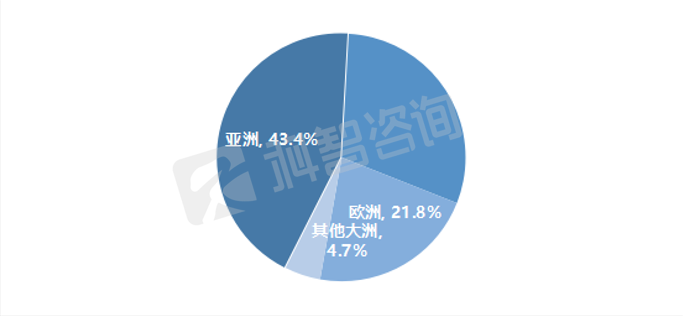

From a regional perspective, Asia, North America and Europe are the three largest regional markets in the global data center industry. In 2021, the data center market in Asia will reach US$33.2 billion, accounting for 43.4% of the total global data center market, making it the largest data center market in the world; North America and Europe will have a data center market size of US$23.02 billion and US$16.72 billion respectively , accounting for 30.1% and 21.8% of the total size of the global data center market; the total market size of the data center industry in South America, Africa and Oceania is US$3.61 billion, accounting for a relatively small proportion of less than 5%.

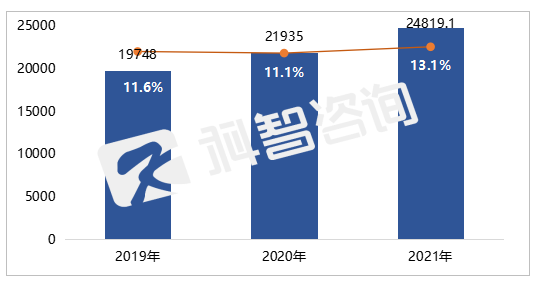

In 2021, the total supply of global data center resources will be 24,819MW, a year-on-year increase of 13.1%, and the growth rate of data center industry supply will accelerate.

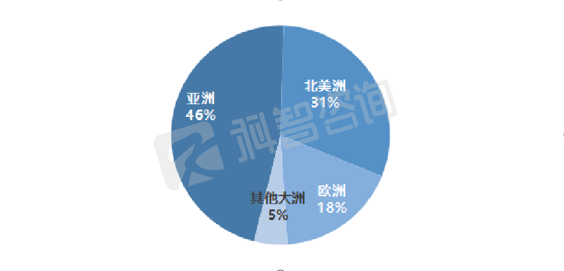

Global data center resources are mainly concentrated in Asia, North America and Europe, and the total supply of data center resources in other continents is relatively small. By the end of 2021, data center resources in Asia, North America, and Europe accounted for about 95%, of which the total resource supply in Asia reached 11,538MW, accounting for about 46.5% of the total global data center resources, making it the world's largest collection of data center resources area. North American and European data center resource supply was 7596MW and 4429MW respectively, accounting for 30.6% and 17.8% respectively. The total amount of data center resources in South America, Oceania, and Africa is relatively small, accounting for about 5.1% in total, and they are mainly concentrated in countries such as Australia, Brazil, and South Africa. In short, the supply of global data center resources is significantly regional, mainly concentrated in continents with large populations and rapid economic development.

1、Overview of Asian data center market development

The Asian data center market is mainly concentrated in mainland China in East Asia, followed by Japan and South Korea in East Asia, Singapore in Southeast Asia, and India in South Asia. In 2021, the total supply of data center resources in mainland China will account for about 60% of the total supply of data centers in Asia. The continuous improvement of China's digital industrialization and industrial digitalization level and the strong support of the Chinese government are the key to the rapid development of data centers. Japan, South Korea, Singapore and India account for about 25% of the total supply of the Asian data center market.

Especially in Japan and Singapore, the rapid development of the digital economy, complete infrastructure for data center construction, and close ties with European and American economies provide a good development environment for data centers. However, in recent years, land and power resources have tended to be tight, restricting the continued development of data centers. However, in recent years, land and power resources tend to be tight, which restricts the sustainable development of data centers. In addition, in Southeast Asian countries such as Indonesia, Malaysia and Thailand, the government attaches great importance to the development of digital economy and the gradual improvement of network infrastructure construction, which provides a good environment for the development of data centers, and the data center market will usher in rapid development.

2. Overview of European data center market development

The European data center market size accounts for 21.8% of the entire world data center market size, which is lower than that of Asia and North America. Insufficient economic momentum, negative population growth, and limited land and power resources are the most important factors hindering the development of European data centers. The European data center market is mainly dominated by international data center operators, and local data center operators are less competitive.

More than 70% of European data center resources are distributed in Western Europe; followed by Southern Europe and Northern Europe. Western Europe has the famous "FLAP data center markets" in Europe, namely Frankfurt (F), London (L), Amsterdam (A) and Paris (P). As a veteran data center primary market in Europe, FLAP accounts for about 70% of the total European data center market. Major data center service providers such as Equinix and NTT, as well as large international public cloud service providers such as Facebook, Microsoft, and Google, are deployed here . At the same time, Western Europe also has Ireland, a typical representative of the European data center secondary market. In 2021, Ireland will become the fastest growing data center market in Europe with a growth rate of 25%. According to the number of data centers approved for planning permission, Ireland will invest another 7 billion euros in data center construction in the next five years.

As a typical data center secondary market in Europe, Northern Europe has always been a favorable investment destination for the development of hyperscale data center service providers, hosting service providers and encrypted currency data center service providers, and has witnessed a number of cloud and hyperscale providers. Investments, such as Facebook's expansion in Sweden, Google's expansion in Finland, and Microsoft's choice to invest in multiple data centers in Norway, in addition to several hosting service providers are also investing in the Nordic region.

Central and Eastern Europe is expected to have more than 365 million internet users and more than 2 billion connected devices in 2022, a growth that will increase data center demand and investment in the region.

In the next three years, the growth rate of European data centers will tend to slow down, and its proportion in the world's data center supply will decrease year by year. It is estimated that in the next three years, the average annual growth rate of new data center resources in Europe will be less than 7%.

3 Overview of North America Data Center Market Development

By the end of 2021, the North American data center colocation market will reach US$23.02 billion, with a growth rate of 12%. The data center hosting market in North America accounts for 30.1% of the world data center market, which is lower than Asia but higher than Europe.

The United States has dominant advantages over other countries in North America with its economic aggregate and faster economic growth rate. US digital economy accounts for more than 60% of the total GDP, laying a good foundation for the rapid development of the data center industry, accounting for more than 90% of the data center market in North America; US is followed by Canada and Mexico and other countries. Due to the gradual shortage of land and power resources in the United States, the increase in operating costs of data centers, and the acceleration of digitalization in other North American countries, major data center service providers are gradually expanding to Canada, Mexico and other neighboring countries of the United States. International data center service providers Equinix and Digital Realty have deployed data centers in Canadian cities such as Toronto, Montreal, and Vancouver. In November 2021, Amazon also announced a new data center in Western Canada, which is expected to be put into operation in 2023; CyrusOne and two Brazilian Data center service providers Odata and Ascent are also speeding up the deployment of data centers in Mexico. At the same time, Microsoft Cloud, Huawei Cloud and IBM Cloud all have their own available cloud areas in Mexico.

4 Overview of Data Center Market Development in Other Regions

By the end of 2021, other regions, including Oceania, South America and Africa, will have a data center colocation market size of US$3.61 billion, with a growth rate of about 9.7%, accounting for only about 5% of the world's data center market size, far lower than other countries in the same period. continents. Because the economic development level of these three continents is relatively low, the development speed of the digital economy is much lower than that of other continents, coupled with the constant local conflicts at home and abroad, and political instability, resulting in fewer data center customer resources. Overall, the infrastructure environment of data centers such as power and network is relatively backward, and the construction cost of data centers is high. These factors lead to the slow development of data centers in Oceania, South America and Africa.

The data center markets in Oceania, South America and Africa are mainly concentrated in countries with a high level of economic development, such as Australia, New Zealand, Brazil and South Africa. In 2021, the supply of data centers in Australia will exceed 500MW, which is the country with the largest supply of data center resources on these three continents; followed by Brazil, the data center market has continued to expand since 2019, and the supply of data centers in 2021 will exceed 300MW.

In the next three years, data center markets in other regions will enter a stage of potential development. However, due to political, economic, and infrastructure constraints such as networks and electricity, there is still a long way to go for the data center market to develop rapidly.

In short, driven by the needs of customers in industries such as cloud computing, the global data center market will continue to grow. It is estimated that by 2024, the global data center market will reach US$109.78 billion. From 2022 to 2024, the growth rate of the global data center industry will remain above 12.4%, providing a guarantee for the development of the digital economy.

About IDCNOVA

IDCNova (Website: www.idcnova.com) is registered under the Hong Kong based Digital Intelligence International Company Limited. As the international presence of Zhongke Zhidao (Beijing) Co Ltd, Ditital Intelligence International aimes at establishing IDCNOVA as a professional media and consulting organization focusing on Internet data center and cloud computing industry, with proactive participation in global emerging markets.

IDCNOVA shares the parent company's unparalleled industry resources and influences in China to track the growth of the ecosystem by delivering news and professional advise on data center in China.

Research Report

2021-2022 China Data Center Industry Electromechanical Equipment Market Research Report

![]() 2021-2022 China Data Center Industry Electromechanical Equipment Market Research Report.pdf

2021-2022 China Data Center Industry Electromechanical Equipment Market Research Report.pdf

2020-2021 China IDC Market Research Report

![]() Sample 2020-2021 China IDC Market Research Report.pdf

Sample 2020-2021 China IDC Market Research Report.pdf

2020-2021 IDC Market Analysis Report in Beijing and Surrounding Areas

![]() Sample 2020-2021 IDC Market Research Report for Beijing and Surrounding Areas.pdf

Sample 2020-2021 IDC Market Research Report for Beijing and Surrounding Areas.pdf

2020-2021 IDC Market Analysis Report in Shanghai and Surrounding Areas

![]() Sample 2020-2021 IDC Market Research Report for Shanghai and Surrounding Areas.pdf

Sample 2020-2021 IDC Market Research Report for Shanghai and Surrounding Areas.pdf

2020-2021 IDC Market Research Report for Guangzhou-Shenzhen and Surrounding Areas

![]() 2020-2021 IDC Market Research Report for Guangzhou-Shenzhen and Surrounding Areas.pdf

2020-2021 IDC Market Research Report for Guangzhou-Shenzhen and Surrounding Areas.pdf

For industry insights, please contact [email protected]

English Website: www.idcnova.com

Wechat Account:

Twitter: @idcnova