2020-2021 China Data Center Industry Main M&A Activities | |

2022 Q1 | Blackstone Group invested 1.58 billion yuan in 21Vianet |

Sequoia Capital and STT GDC invested 3.92 billion yuan in GDS, | |

Mubadala's investment 3.16 billion yuan in Princeton Digital Group (PDG) | |

2021 | Singapore Keppel DC REIT invests 700 million yuan in Neo Telemedia |

Baoneng Chuangtan took over 5 data center from Dr. Peng with total consideration of RMB 1.65 billion | |

CapitaLand invests 3.66 billion yuan in Deli Schindler | |

2020 | Macquarie invested 1.616 billion yuan in Bohao data |

ABS invested 1.106 billion yuan in Sino-Ocean Data | |

Alpha Data Center Fund invests 1.5 billion yuan in ecological smart data center | |

Investment and Financing Features of Current Data Center Market in China

The active investment and financing activity is a direct reflection of the investors' confidence in the market, which proves that the current data center industry has high investment value and good development prospects. From the actual situation, data center investment and financing activities show obvious trend characteristics in terms of capital composition, investment area, and financing situation.

Capital composition: for profits or business expansion, data center industry has attracted an increasing number of capitals to join in. The capitals could be mainly divided into two types: one is from financial investor, and they tend to take a stake in a data center company or project to get a return on investment, such as Morgan Stanley and Blackstone Group; the other type is industry investor, and they rely on their own advantageous resources such as land, electricity and customers to enter the traditional IDC industry and participate in IDC operations, such as Keppel’s acquisition of Weihai Zhigu Data Center in Jiangmen City, Guangdong Province.

Investment Regions Selection: For the regions to invest, the core cities in eastern China and surrounding areas are still hot spots for investment, and the investment in the western China data center hub nodes is increasing. According to KZ Consulting, the core cities have developed Internet industries, concentrated customers, and are close to network backbone nodes, so the demand for data centers is strong. However, due to the influence of policies and resources, the planning and construction of data centers are extending to surrounding areas. At the same time, the investment value of the Chengdu-Chongqing area is becoming more prominent. As the only "East Data" hub node in the western China, the Chengdu-Chongqing hub node has a vast market with completed network facilities and encouraging policies, and it is becoming the focus of emerging investment in data centers. Besides, with the support of “East Data and West Computing” policy, the four western hub nodes of Gansu, Inner Mongolia, Guizhou and Ningxia will also become new investment growth points.

Data Center Financing: In terms of data center financing, green financial policies provide effective financing support for the development of green data centers. According to KZ Consulting, with the support of policies, in the first three quarters of 2021, the scale of green loans and bond financing increased by more than 51% compared with the whole year of 2020 in China, and among green loans, more than half of them went to the infrastructure industry, and the increment of loans also went to clean energy and the upgrading for infrastructure. The green development trend of data centers industry is obvious, and the R&D and application scope of energy-saving and carbon-reducing technologies, such as liquid cooling and heat recovery, have expanded.

Risks for Data Center Investment

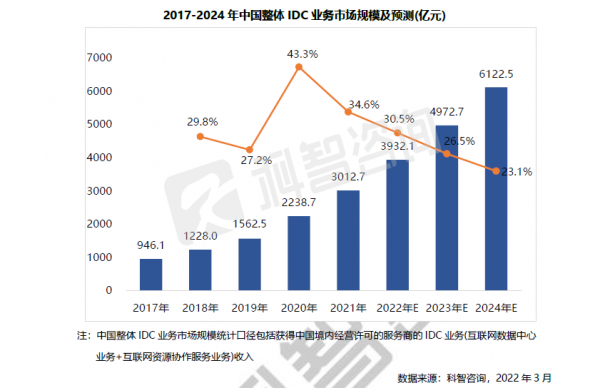

The Review of the “Positive” China Data Center Market: data center market has a rapid expansion rate. The market scale is projected to be 6, 122.5 yuan, and the CAGR of 15.9% there will be a 15.9% CAGR amid 2022-2024. Moreover, the data center has both the fixed asset value of land, buildings and electromechanical equipment, as well as the operating value of generating cash flow and profits through professional operation after the construction is completed, which reflects its high investment value. The industry is attracting capitals.

However, promising investment and financing does not mean zero risks, and the prosperity of the industry does not mean that all companies can develop rapidly. With a prospective development trend, investing in data center companies has a high probability of achieving good returns, but there are still risks, which are mainly reflected in the following aspects:

1) The risks from the data center itself: From the analysis and view of KZ Consulting, the data center industry has real estate attributes including large initial investment and long capital return cycle, so that the insufficient funds have become an important obstacle to the business expansion of data center enterprises, especially small and medium-sized IDC enterprises. If there is not enough capital, it will gradually lose the dominant position in the market and the enterprise benefits will be harder to guarantee and the investment will be difficult to return.

2) Risks from the changing policy and regulation: the China energy consumption supervision is strengthened, and the requirements for energy conservation and carbon reduction are raised, which will affect the construction, operation and related costs of data centers, as well as the final investment income. At present, green supervision is becoming more and more strict. Existing data centers may be shut down due to inability to apply for energy consumption indicators or excessive energy consumption. They may also face upgrades and relocations. New data centers may also fail to pass energy-saving approvals. In the operation process, in order to reduce the PUE value, the data center needs to adopt more advanced cooling technology. All of the above will increase the cost of project construction and operation, which will lead to lower corporate profits and even losses, and increase investment risks.

3) Risks from the dynamic market: when the supply increases and market competition intensifies, the cabinets occupation ratio rate will be greatly affected. On the one hand, the new infrastructure policy has triggered a boom in data center construction and the top IDC companies have adopted the "self-build + acquisition" expansion model to improve their supply capacity; some companies with core resources have entered the IDC industry across borders, which has also led to rapid growth in market supply. On the other hand, leading Internet companies continue to build their own data centers and divert some of the IDC demand, but the new industrial Internet demand cannot make up for this demand vacancy in the short term, resulting in a decrease in IDC demand. That is to say, the supply has increased rapidly, but new demand has not followed. The market needs a certain digestion cycle, which leads to more intense competition and affects corporate profits.

It can be seen that the overall development of data centers is in a golden period of growth, but investment risks still exist. Analysts from Kezhi Consulting pointed out that data center investment and financing reflects that the industry is in a stage of rapid development and there are many and high-quality investment opportunities, but there are many factors that affect the development of enterprises and investment returns. From the perspective of the growth of current investment income and future income, investors focus on the company's current market share and future growth space, and the influencing factors include the company's resource acquisition ability, customer acquisition ability, and the company's existing project asset status. In addition, as a digital real estate, the investment value of data centers is greatly affected by the actual operating conditions. Investors also need to pay attention to project customer resources, geographical location, and future operating levels when carry out investment activities. Therefore, it is necessary for investors to review and have a comprehensive and in-depth understanding of policies, industry status, and corporate development in China data center field.

From more data center investment analysis in China, please contact [email protected]

About IDCNova

IDCNova (Website: www.idcnova.com) is registered under the Hong Kong based Digital Intelligence International Company Limited. As the international presence of Zhongke Zhidao (Beijing) Co Ltd, Ditital Intelligence International aimes at establishing IDCNOVA as a professional media and consulting organization focusing on Internet data center and cloud computing industry, with proactive participation in global emerging markets.

IDCNOVA shares the parental company's unparalleled industry resources and influences in China to track the growth of the ecosystem by delivering news and professional advise on data center in China.

For industry insights, please contact [email protected]

English Website: www.idcnova.com

Chinese Website: www.idcquan.com

Wechat Account:

Twitter: @idcnova