Southeast Asia's e-commerce market is estimated to be worth US$53 billion by 2023 and is emerging as a hot battleground amongst China's tech giants, which have been investing aggressively to establish their footprint in the region. Fuelled by growing smartphone adoption and local economies, Southeast Asia would grow at a compound annual growth rate (CAGR) of 23 percent over the next years to hit US$53 billion, up from US$19 billion this year.

Indonesia was the largest market, accounting for 41 percent of the region's online retail market, but the Philippines would clock the fastest growth rate--thanks to its social media users, according to a report by market researcher Forrester. Other Southeast Asian markets included in its report were Singapore, Malaysia, Thailand, and Vietnam.

The report, which was authored by Forrester's senior forecast analyst Satish Meena, estimated that Indonesia's online retail sales this year would touch US$7.6 billion, while Vietnam would hit US$2.8 billion and Malaysia would see US$2.2 billion in online retail sales. The Philippine online retail market would expand at a CAGR of 30.4 percent during the forecast period as the country's social media users take to online shopping.

Southeast Asia had been increasingly attractive for retailers, Meena added, noting that Southeast Asian internet companies had raised more than US$13 billion in capital since 2015. The added funds had helped the market players invest aggressively in retail services, wrote the New Delhi-based Forrester analyst. Singapore saw the highest level of investment, luring 58 percent of total investment in Southeast Asia from 2016 to third-quarter 2017, compared to Indonesia's 34 percent.

Citing estimates from the World Economic Forum, Meena said the region was projected to be the world's fifth-largest economy by 2020. It already boasted a collective economy worth US$2.6 trillion, growing at an average rate of 5 percent, and was home to 574 million. Online and smartphone adoption also was growing in the region, where nearly half of its population already were online and 303 million owned smartphones. He added that mobile would account for 74 percent of online retail sales in 2023, up from 58 percent this year.

He said the Southeast Asian retail market was worth US$590 billion, presenting significant opportunities for markets such as retail, CPG (consumer packaged goods), and logistics. He explained that the region had an underdeveloped offline retail market, with one of the lowest levels of retail gross floor area and limited stock keeping units (SKUs) due to logistics costs." As a result, the region's shoppers are leapfrogging to e-commerce; they are prepared to make purchases on online marketplaces instead of in offline stores," Meena wrote.

CHINA TECH GIANTS BATTLE FOR SEA RETAIL PIE, WHILE AMAZON FOCUSES ON INDIA

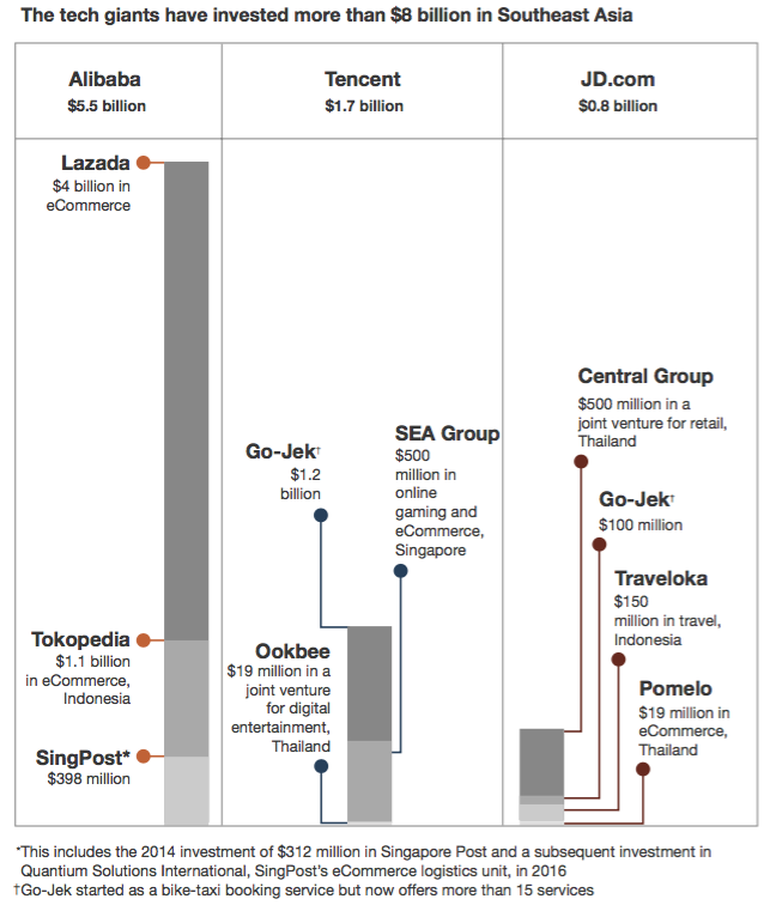

With the region offering significant growth potential, Chinese tech giants were poised to battle for a piece of the retail market. Pointing to Alibaba, Baidu, Didi, JD.com, and Tencent, Meena said these market players invested more than US$8 billion last year in the region's e-commerce, logistics, and payments markets.

Alibaba, for instance, began pouring in funds since April 2016 when it invested US$1 billion in Lazada for a controlling 51 percent stake and another US$1 billion a year later to boost its share to 83 percent. It put in a further US$2 billion in March 2018. The Chinese e-commerce giant in September 2018 also invested US$1.1 billion in Indonesia marketplace Tokopedia, indicating the region was a priority for Alibaba, noted Meena. It also invested S$312 million in Singapore Post (SingPost) for a 10.35 percent stake in 2014 as well as a 34 percent share in SingPost's e-commerce logistics arm, Quantium Solutions International, for an estimated S$92 million in 2015.

Tencent, too, had been beefing up its gameplay in Southeast Asia, throwing US$500 million into e-commerce platform Shopee in May 2017, said Meena. The Chinese internet giant also invested US$1.2 billion in Indonesian ride-sharing app, Go-Jek, which since had expanded its service offerings to include payments and food delivery.

JD.com also launched its local site in Indonesia in 2015 and its first "cashier-free" store there in 2018. Its other investments in the region included Vietnamese online retailer Tiki, Go-Jek, and Thailand's online fashion retail player, Pomelo.

(Source: Forrester)

Whilst the Chinese players busied themselves with Southeast Asia, Amazon meanwhile had been focused on the Indian market, noted Meena. However, the US e-commerce player was expected to invest in Southeast Asian next year, he said. "With increasing competition in India from Walmart, after the acquisition of Flipkart and investment by Alibaba, Amazon is taking its time in Southeast Asia," the Forrester analyst said, adding that Amazon had taken a "watch-and-wait" stance after launching its Prime services in Singapore in July last year.

"However, Amazon is already starting to work with sellers in Southeast Asia. In Vietnam, it partnered with the Vietnam E-Commerce Association of Online Merchants (VECOM) in March 2018," he said. This partnership would offer VECOM members a platform to boost their exports of local-made goods, Meena said, adding that it was expecting Amazon to make strategic moves to sell goods in the Vietnamese market next year.