Table of Contents

Chapter 1 Overview of the China IDC Market

1.1 Analysis of the Development Policy Environment for the Chinese IDC Industry

1.2 Analysis of the Development of the Chinese IDC Industry in 2020

1.3 Analysis of the Future Development Trends of the Chinese IDC Industry

Chapter 2 Analysis of the Development Environment for the IDC Market in Shanghai and Surrounding Areas

2.1 Analysis of the Policy Environment

2.2 Analysis of the Economic Environment

2.3 Analysis of Supporting IDC Resources

Chapter 3 Overview of the IDC Market in Shanghai and Surrounding Areas

3.1 Basic IDC Market Characteristics of Shanghai and Surrounding Areas

3.2 Analysis of the Size and Status of the Shanghai IDC Market

3.3 Analysis of the Supply and Demand of the Shanghai IDC Market

Chapter 4 Analysis of the Demand of the IDC Market in Shanghai and Surrounding Areas

4.1 Characteristics of Demand in the Shanghai IDC Market

4.2 Size of Demand in the Shanghai IDC Market

4.3 Analysis of Key Industry Customers for the Shanghai IDC Market

4.4 Demand Forecast for the Shanghai IDC Market

Chapter 5 Analysis of the Supply of the IDC Market in Shanghai and Surrounding Areas

5.1 Analysis of the Supply of the Shanghai IDC Market

5.2 Analysis of the Supply of the IDC Market in Shanghai and Surrounding Areas

5.3 Supply Forecast for the Future Shanghai IDC Market

Chapter 6 Analysis of Competition in the IDC Market in Shanghai and Surrounding Areas

6.1 Analysis of Competition in the Shanghai IDC Market

6.2 Analysis of Competition Among Foundation Telecom Operators in the Shanghai IDC Market

6.3 Analysis of Competition Among Third-Party IDC Providers in Shanghai

6.4 Future Competition Trends for the Shanghai IDC Market

Chapter 7 Analysis of Investment into the IDC Industry in Shanghai and Surrounding Areas

7.1 Investment Volume of the IDC Industry in Shanghai and Surrounding Areas

7.2 Analysis of Investment Risk for the IDC Industry in Shanghai and Surrounding Areas

7.3 Investment Advice for the IDC Industry in Shanghai and Surrounding Areas.

Appendix 1: Glossary

Appendix 2: Report Description

Table of Figures

Figure 1 Growth of the Chinese IDC Market From 2015-2020 (CNY 100 million)

Figure 2 Growth of the Traditional Chinese IDC Market From 2015-2020 (CNY 100 million)

Figure 3 Structure of the Chinese IDC Market From 2019-2020

Figure 4 Structure of the Chinese Traditional IDC Market in 2020

Figure 5 Forecasted Growth for the Chinese IDC Market From 2020-2023 (CNY 100 million)

Figure 6 Forecasted Growth for the Chinese Traditional IDC Market From 2020-2023 (CNY 100 million)

Figure 7 Sentiment of IDC Providers Towards the Future Growth of Internet and Cloud Demand

Figure 8 Demand Forecast for Leading Internet Service Companies From 2021-2023

Figure 9 Sentiment of IDC Providers Towards the Future Growth of IDC Demand in Traditional Sectors

Figure 10 Forecasted Growth for Investment into Chinese IDC Industry Projects From 2018-2023 (CNY 100 million)

Figure 11 The Digital Economy of Shanghai Facilitates the Development of the Data Centre Industry

Figure 12 Data Centre Industry Development Policies in Shanghai and Surrounding Areas

Figure 13 Industry Structure of Shanghai in 2020

Figure 14 Industry Structure of Suzhou in 2020

Figure 15 Industry Structure of Nantong in 2020

Figure 16 Shanghai Bandwidth Exports From 2019-2020(Gbps)

Figure 17 Resources in Shanghai and Surrounding Areas

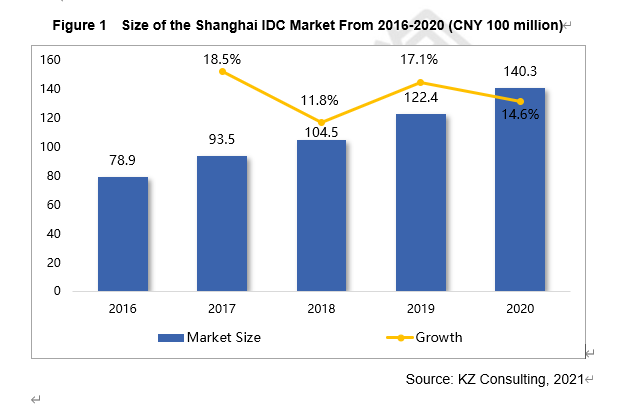

Figure 18 Size of the Shanghai IDC Market From 2016-2020 (CNY 100 million)

Figure 19 Structure of the Shanghai IDC Market in 2020

Figure 20 Sales Structure of Shanghai IDC Service Providers in 2020

Figure 21 Structure of Shanghai IDC Market Customers in 2020

Figure 22 Demand Characteristics of IDC Industry Customers

Figure 23 Online Gaming Revenue in Shanghai from 2016-2019(CNY 100 million)

Figure 24 Value Provided from the Shanghai Financial Industry From 2016-2020 (CNY 100 million)

Figure 25 Machine Room Requirements of Traditional Sector Customers

Figure 26 Customer Structure Forecast for the Shanghai IDC Market

Figure 27 Local Distribution of Shanghai IDC Rack Resources in 2020

Figure 28 Distribution of Machine Rooms Between Foundational Telecom Operators and Third-Party IDC Service Providers in 2020

Figure 29 Vacancy Rate of IDC Machine Rooms in Shanghai (2020)

Figure 30 Local Distribution of New Rack Resources in Shanghai

Figure 31 Approval of Data Centre Projects in Shanghai (2020)

Figure 32 Heat Distribution Map of Delivered Data Centres in Nantong

Figure 33 Planned Data Centre Resources in Nantong (Partial Only)

Figure 34 New Data Centres in Suzhou Over the Next Three Years (Partial Only)

Figure 35 Supply Forecast for Shanghai IDC Rack Resources From 2020-2023

Figure 36 Market Share of Foundational Telecom Operators in Shanghai (2020)

Figure 37 Market Share of Third-Party IDC Providers in Shanghai (2020)

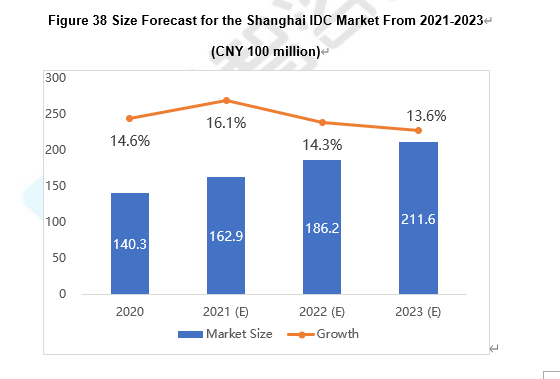

Figure 38 Size Forecast for the Shanghai IDC Market From 2021-2023 (CNY 100 million)

Figure 39 Structure Forecast for Shanghai IDC Market Demand From 2020-2023

Figure 40 Structure of IDC Construction Costs in Shanghai and Surrounding Areas (2020)

Figure 41 Structure of IDC Electrical and Mechanical Construction Costs in Shanghai and Surrounding Areas (2020)

Figure 42 Planned/Under-Construction Data Centres in Areas Surrounding Shanghai (Partial Only)

Figure 43 Data Centre Construction and Operation Process

Main Conclusion

1. The data centre market in Shanghai and surrounding areas has grown steadily. In 2020, the size of the data centre market in Shanghai reached CNY 14.03 billion, representing an increase of 14.6% from 2019.

The rapid development of the industry can be attributed to the growth of demand for data centres in Shanghai. As the financial centre of China, Shanghai is the home of many large Internet companies such as Pinduoduo and Bilibili, along with financial companies such as the Bank of Communications and Pacific Insurance. The city has a high demand for data centres, with higher rack utilization than the national average. In recent years, the Shanghai area has tightened energy efficiency and construction approval requirements for third-party IDCs. The pandemic situation in 2020 also delayed the deployment of certain data centre projects, which resulted in an overall slowdown in the growth of the Shanghai IDC market.

2 The New Infrastructure Plan has encouraged the development of the data centre industry in Shanghai.

On May 2020, the Shanghai Municipal People’s Government issued the “Action Plan to Promote New Infrastructure Construction in Shanghai (2020-2022)”, which proposed investments totalling CNY 270 billion in various new infrastructure projects within a 3-year period. Driven by relevant policies, the construction of data centres in Shanghai will become more integrated with industries such as manufacturing, finance, and AI.

3 The Supply of Data Centres in Shanghai is Limited and Demand is Gradually Shifting Towards Surrounding Areas.

The supply of land, electricity, and other resources in Shanghai is limited, and municipal policies have set higher requirements for the energy efficiency on new data centres. At present, data centre racks in Shanghai do not meet the local demand for IDC resources.

The pandemic situation in 2020 has delayed data centre development. Certain new data centres have yet to be commissioned, and supply is failing to keep up with demand. In order to meet their deployment needs, some customers will transfer applications with relatively low real-time requirements to Nantong, Suzhou, and other surrounding areas. Other customers may also deploy data centres in these areas to save on rack and network access costs.

4 Suzhou, Nantong, and Other Areas Surrounding Shanghai are Developing Their Data Centre Industries and Undertaking IDC Projects to Meet the Overflow of Demand.

Influenced by the Yangtze River Delta Regional Integrated Development Plan, Suzhou, Nantong, and other areas surrounding Shanghai have issued policies to encourage the development of their respective data centre industries, with the goal of meeting the overflow of demand from Shanghai. At present, third-party IDC providers such as Centrin Data Systems, GDS, Range Technology, and AtHub are all in the process of deploying data centre projects in Suzhou and Nantong. Ultra-large Internet companies such as Alibaba and JD.com are also in the process of constructing industrial parks and data centres in Nantong. At present, over 300,000 racks are under construction or in planning in Suzhou, Nantong, and other areas surrounding Shanghai. The scale of development will be able to effectively handle the overflow of demand from the Shanghai area.

5 We project that from 2021-2023, the Shanghai IDC market will continue to grow at a relatively high rate, and exceed CNY 20 billion in size by 2023.

In 2020, certain energy efficiency quotas were relaxed for AI and cloud computing data centres. The “Action Plan to Promote New Infrastructure Construction in Shanghai (2020-2022)” also considered the construction of a new batch of IDC racks, which will lower the rate in which growth has fallen since 2018. In the future, major IDC providers will place greater emphasis on energy efficiency during development and construction; large Internet companies such as Baidu, Alibaba, and Tencent will further invest into the construction on data centres in the Shanghai area; and the regional IDC market will continue to grow.

Demand in the Internet sector (e-commerce, video games, and video platforms) has remained stable. Traditional sectors such as manufacturing are accelerating their digital transformation processes, encouraged by favourable policies and increasing demand. Applications such as automatic factories, Internet-integrated hospitals, and smart logistics are gradually seeing adoption by traditional sectors, and will accelerate the growth of regional IDC resource demand in the future.

Companies Mentioned

China Telecom 中国电信

China Unicom 中国联通

GDS 万国数据

21Vianet 世纪互联

Dr. Peng Group 鹏博士

China Telecom (Shanghai) 上海电信

Baosight 宝信软件

Baocloud 宝之云

China Unicom (Shanghai) 上海联通

China Mobile (Shanghai) 上海移动

Centrin Data Systems 中金数据

Range Technology 润泽科技

AtHub 数据港

Bank of Communications 交通银行

Pacific Insurance 太平洋保险

SenseTime 商汤科技

Sinnet 光环新网

Guofu Guangqi 国富光启

Yovole Networks 有孚网络

UCloud 优刻得

UP-TO Technology 上海极有

SISDC 苏州国科

oneAs1a 亚洲脉络

ZTEICT 中兴网信

Guodong Technology 国动科技

Key Cloud 锦富旗云

Kehua Data科华数据

DC Science 德衡数据

2020-2021 IDC Market Research Report for Shanghai and Surrounding Areas

Pages: 83

Word Count: 30,000+

Figure/Table: 44

Price:

Chinese Digital Version: USD 8,500.00

English Digital Version: USD 10,000.00

Chinese and English Version: USD 11,000.00