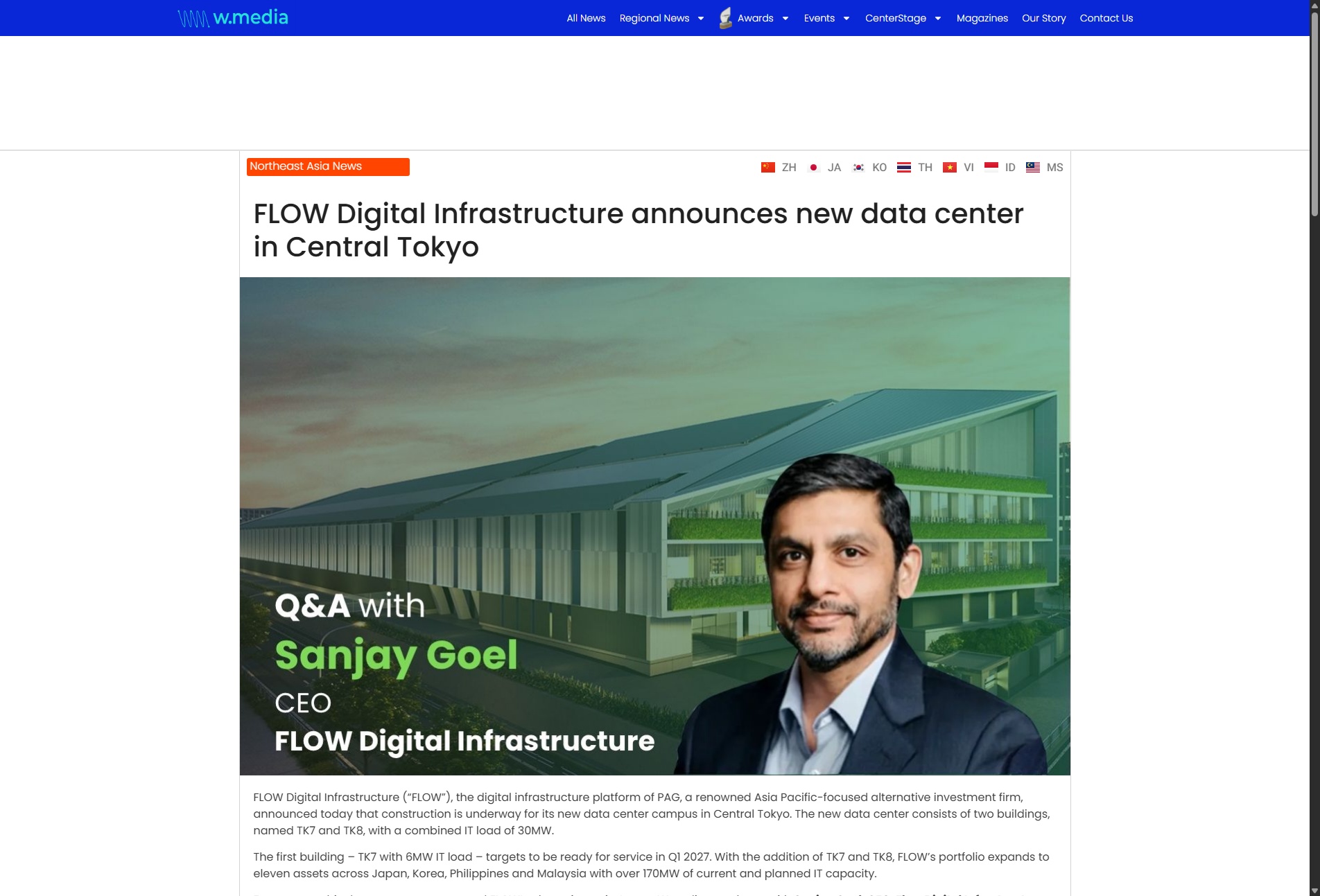

FLOW Digital Infrastructure (“FLOW”), the digital infrastructure platform of PAG, a renowned Asia Pacific-focused alternative investment firm, announced today that construction is underway for its new data center campus in Central Tokyo. The new data center consists of two buildings, named TK7 and TK8, with a combined IT load of 30MW.

The first building – TK7 with 6MW IT load – targets to be ready for service in Q1 2027. With the addition of TK7 and TK8, FLOW’s portfolio expands to eleven assets across Japan, Korea, Philippines and Malaysia with over 170MW of current and planned IT capacity.

For more on this data center campus, and FLOW’s plans vis-a-vis Japan, W.Media caught up with Sanjay Goel, CEO, Flow Digital Infrastructure.

In your previous interview with us, just after you had been named CEO, you had reiterated FLOW’s interest in Japan. How is this new facility part of the broader plan?

This new TK7 & TK8 facility marks FLOW’s seventh asset in Japan out of the 11 assets we have across Asia. This development represents a significant milestone in our ongoing expansion strategy. It also underscores our long-term commitment to Japan as a key growth market where we see significant demand-driven opportunities.

One cannot deny that Tokyo is one of the most expensive DC markets in the world! Despite this, it is playing a role in your growth plans. What’s the allure of Tokyo for you?

Tokyo is a global financial and technology hub with a dense connectivity ecosystem and proximity to major hyperscale and enterprise customers. We believe Tokyo’s position will be increasingly more important as global and Asian firms grow their footprint in Asia Pacific. Tokyo’s unique financial & tech-hub position drives substantial demand, especially as digital transformation and AI adoption accelerate across Japan. Both government and industry initiatives, such as Japan’s focus on sovereign AI and partnerships with the likes of NVIDIA, are fueling rapid AI ecosystem development.

Despite costs, Tokyo’s strategic importance and the amount of innovation that we’ve seen across both private and public sectors make it a priority market for FLOW within our strategy for Japan. Our long-standing presence in Tokyo goes back to 1997. We’ve witnessed several market cycles in Japan and believe the current transformative trends require resilient and tailored data center infrastructure to support customers’ growing data needs.

What kind of supply constraints and demand complexities afflict Tokyo’s digital infrastructure market, and how is the new facility poised to offer a solution?

From 2026/2027 onwards, we foresee the Central Tokyo area will experience a supply-demand imbalance, driven by its limited land availability, power constraints and continued increased demand for data center capacity. FLOW has access to off-market land sourcing and extensive local networks through PAG. This is essential as we navigate the real estate related constraints.

TK7 and TK8 campus is a two-building site that is strategically located near the key data center clusters of Otemachi and Toyosu. It is one of the largest scalable colocation facilities in the Central Tokyo area.

As you pointed out, there are many challenges to develop facilities in prime locations in Tokyo, such as rising construction costs, shortages of General Contractor and vendor availability, among others. However, we benefit from our established vendor relationships built through decades of partnerships, as well as our in-house project management expertise.

How do you see the hyperscale colocation market evolving over the next five years?

The hyperscale colocation market is evolving amidst complexity and change. Hyperscalers are increasingly investing in self-built facilities, at times competing with data center providers. On the other hand, many hyperscaler customers also need access to facilities to complement their own capacities.

The rapid growth of AI workloads is also driving evolution in data center design. For instance, higher power density racks and liquid cooling systems require more sophisticated engineering.

What is your assessment of the connectivity infrastructure in Japan? Is it upgrading fast enough to keep up with the burgeoning demand from data centers?

Although connectivity providers in Japan face the challenge of meeting rapidly increasing demand, they have demonstrated strong forward-looking mentality and innovation capability. For example, the rollout of higher-capacity local loops of up to 400 Gbps is underway to support bandwidth growth.

However, the bigger question centers on how network architecture will evolve to meet AI-driven demands, and how network providers as well as data centers could provide designs that are robust enough to support these interconnect cabling complexities.

As we all know, many AI data centers in the U.S. are located in remote, lower-cost areas, whilst Japan and other Asian markets face unique challenges due to dense urban environments, higher land costs and limited space. How can these markets support the specialized infrastructure needs of AI data centers despite these constraints?

What can we expect next from FLOW? What’s coming up next?

Looking ahead, FLOW is exploring further expansion across targeted APAC markets, including Japan, Korea, Philippines and India, where we can serve unmet demand. We are continuously evaluating opportunities in other regional markets such as Thailand and Malaysia as well to expand our footprint in the region.