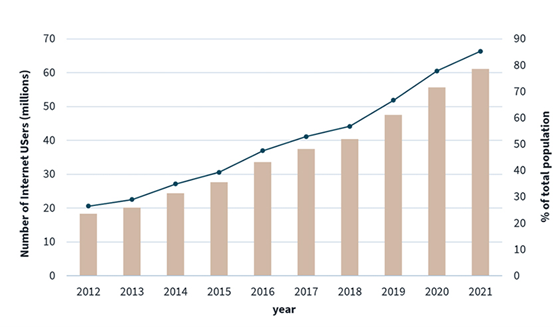

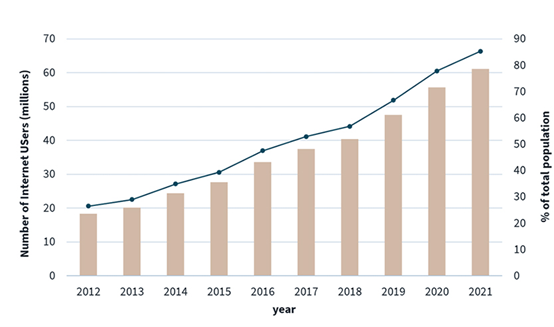

Thailand has experienced a significant surge in demand for data centres over the past few years. This demand is driven by the rapid growth of the country's digital economy and increasing reliance on cloud computing and other online services. In 2021, Thailand's total internet users were recorded at 61 million, which accounted for 85% of the total population. The majority of these users also engage in social media, spending an average of roughly three hours every day on these platforms. Moreover, the COVID-19 pandemic has accelerated the digital transformation of businesses and governments worldwide, including Thailand. The shift towards remote work and online services has led to an increase in demand for data centres to support the growing volume of data traffic.

Other than domestic demand, the rise of data centres in Thailand can be attributed to government incentives. One of the most significant is the BOI (Board of Investment) promotion scheme, which offers a range of tax incentives and other benefits to companies that invest in data centres in Thailand. The BOI promotion scheme includes tax holidays of up to eight years, exemptions or reductions in import duties, and business facilitation services.

Figure 1: Number of internet users in Thailand, 2012-2021

Source: World Bank, analysis by JLL, 2023

To meet the increasing demand, several major players in the industry have invested heavily in Thailand. For instance, in 2021, Singapore-based ST Telemedia Global Data Centres (STT GDC) launched its first hyper-scale data centre in Bangkok with a 20 MW capacity. In 2022, AWS also announced its plan to invest US$ 5 billion in the next 15 years to expand its cloud service capacity in Thailand and the region. Other notable players in the market include TCC Technology Group, CAT Telecom and True Internet Data Centre.

When selecting a location for a data centre, different options can be considered based on the scale and type of services it aims to provide. One suitable option is industrial estates, as data centres share similar requirements to factories. These include access to reliable 22kV or 115 kV power supply from multiple sources to ensure constant availability and protection against flooding through adequate mitigation strategies. These features are often found in typical industrial estates.

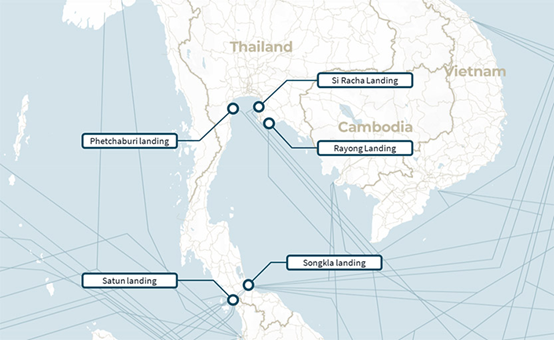

Additionally, proximity to fibre optic networks is essential for fast and reliable data transmission with low latency. It is also essential to have access to multiple internet service providers to ensure uninterrupted connectivity and network neutrality, if necessary. Furthermore, the cost of land is a significant factor, and the chosen location should offer a favourable balance between land and construction costs to determine the most appropriate building design and density for the site.

Figure 2: Thailand submarine cable landings

Source: JLL Research, 2023

Thailand's flourishing digital economy and government incentives have created an attractive new opportunity in the real estate market. Landlords equipped with the necessary infrastructure can capitalise on this growth by accommodating the increasing demand for data centres. This emerging sector will play a crucial role in supporting and contributing to the country's vision of Thailand 4.0 digital economy.