Simplified Version: 2019-2020 Southeast Asia Internet Data Center Industry Development Research Report

Body Content

Chapter 1 Southeast Asia IDC Industry Development Environment Analysis 6

Section 1 Southeast Asia IDC Industry Development Basic Environment Analysis 6

I. Southeast Asia IDC Industry Development Economic Environment Analysis 6

II. Southeast Asia IDC Industry Development Political Environment 9

III. Southeast Asia IDC Industry Development Social Environment 12

Section 2 Southeast Asia IDC Industrial Development Foundation Resource Environment 15

I. Southeast Asia IDC Industrial Development Electric Power Resource 15

II. Southeast Asia IDC Industry Development Internet Resource Environment 18

III. Southeast Asia IDC Industry Development Land Resource Environment 22

IV. Southeast Asia IDC Industry Development Human Resource Environment 25

Section 3 Southeast Asia IDC Industry Development Political Environment Analysis 26

I. Southeast Asia Overall Policy Environment Overview 26

II. Southeast Asia Main Countries IDC Industry Development Political Environment 26

Section 4 Southeast Asia IDC Industry Development Basic Environment Analysis 30

Chapter 2 Southeast Asia IDC Business Market Scale Analysis 33

Section 1 Southeast Asia Overall IDC Business Market Scale 33

Section 2 Southeast Asia Main Countries IDC Business Market Scale Analysis 34

I. Southeast Asia IDC Business Market Overall Distribution 34

II. Southeast Asia Main Countries IDC Business Market Scale 35

Chapter 3 Southeast Asia IDC Industry Resource Supply Analysis 38

Section 1 Southeast Asia IDC Service Providers Analysis 38

I. Southeast Asia IDC Service Provider Types and Distribution 38

II. Southeast Asia IDC Service Provider Development Strategy Analysis 39

Section 2 Southeast Asia IDC Resources Status Analysis 41

I. Southeast Asia IDC Resource Overall Supply Status 41

II. Southeast Asia Main Countries IDC Resources Supply Status 41

Chapter 4 Southeast Asia IDC Industry Market Demand Analysis 44

Section 1 Southeast Asia IDC Industry Market Demand Overall Features Analysis 44

I. Southeast Asia IDC Industry Overall Demand Features 44

II. Southeast Asia Main Countries IDC Demand Features Analysis 44

Section 2 Southeast Asia Internet Industrial Customers’ Demand Analysis 48

I. Southeast Asia Internet Industrial Customers’ Demand Scale and Growth 48

II. Southeast Asia Internet Industrial Main Business Types 49

III. The Layout of China Internet Enterprises in Southeast Asia Market 50

Section 3 Southeast Asia Cloud Service Providers Demand Analysis 51

I. Southeast Asia Cloud Service Market Development Overview 51

II. Southeast Asia Local Cloud Service Provider Development Status 52

III. International Cloud Service Provider Layout 55

IV. Southeast Asia Cloud Service Market Development Trend 57

Chapter 5 Southeast Asia IDC Industrial Development Trend Analysis 58

Section 1 Southeast Asia IDC Business Market Scale Forecast 58

I. Southeast Asia Overall IDC Business Market Scale Forecast 58

II. Southeast Asia Main Countries IDC Business Market Scale Forecast 58

Section 2 Southeast Asia Future IDC Industry Development Environment Forecast 62

I. Political Environment 62

II. Internet Technology Environment 64

Section 3 Southeast Asia IDC Industrial Competition Layout Forecast 65

Chapter 6 Southeast Asian IDC Industrial Investment Analysis 66

Section 1 Southeast Asia IDC Industrial Investment Barriers Analysis 66

I. Policy Barriers 66

II. Brand Barriers 66

III. Technology Barriers 67

IV. Talent Barriers 67

V. Customer Resources Barriers 67

Section 2 Southeast Asia IDC Industrial Investment Risks Analysis 68

I. Southeast Asia Overall IDC Industrial Investment Risks 68

II. Southeast Asia Main Countries IDC Industrial Investment Risks 69

Section 3 Southeast Asia IDC Industrial Market Entry Suggestions 72

Appendix: Report Instruction 75

Table Contents

Table 1 2019 Southeast Asia Countries Main Economic Indicators 6

Table 2 2019 Southeast Asia Countries Total Tax Rate 9

Table 3 2019 Southeast Asia Countries Political System and Investment Risks Evaluation 9

Table 4 2019 Southeast Asia Population and Age Distribution Status 12

Table 5 2019 Southeast Asia Main Countries Social Environment 13

Table 6 2019 Southeast Asia Main Countries Electric Power Resources Status 15

Table 2019 Southeast Asia Countries Total Tax Rate 19

Table 8 2018 Southeast Asia Countries Total Tax Rate 19

Table 9 “One Belt One Road” Informatization Level Evaluation Index System of Countries along the Route 20

Table 10 Southeast Asia Countries Informatization Development Level 21

Table 11 Southeast Asia Main Countries IT Industry Average Revenue Level 25

Table 12 Singapore Green Data Center Encourage Policies 27

Table 13 Major Departments and Functions Leading the Development of Data Centers in Malaysia 28

Table 14 Thailand Digital Economy and Social Development Plan Main Content 28

Table 15 Southeast Asia Main Countries IDC Development Environment Comparison 31

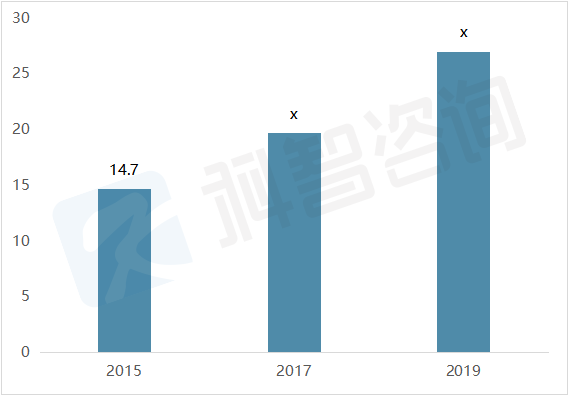

Table 16 2015 - 2019 Southeast Asia IDC Market Scale (Unit: USD 100 million) 33

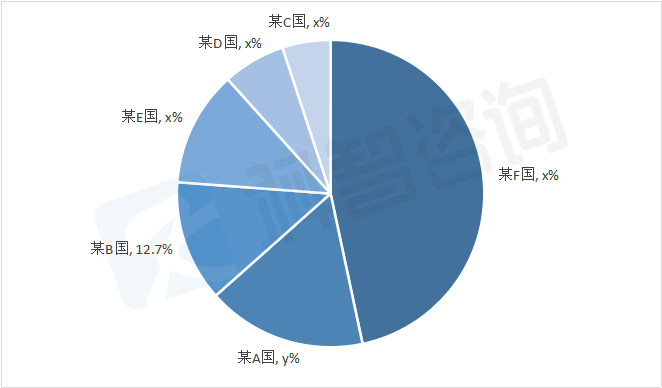

Table 17 2019 Southeast Asia IDC Business Market Scale Nation Distribution 34

Table 18 2015 - 2019 Singapore IDC Business Market Scale (Unit: USD 100 million) 35

Table 19 2015 - 2019 Malaysia IDC Business Market Scale (Unit: USD 100 million) 35

Table 20 2015 - 2019 Thailand IDC Business Market Scale (Unit: USD 100 million) 36

Table 21 2015 - 2019 Indonesia IDC Business Market Scale (Unit: USD 100 million) 36

Table 22 2015 - 2019 Philippines IDC Business Market Scale (Unit: USD 100 million) 37

Table 23 2015 - 2019 Vietnam IDC Business Market Scale (Unit: USD 100 million) 37

Table 24 Southeast Asia IDC Service Provider Types 38

Table 25 Southeast Asia Different Types of Service Providers Market Share 39

Table 26 2019 Southeast Asia Data Center Resource Supply Status 41

Table 32 2019 Southeast Asia IDC Market Customer Demand Distribution 44

Table 33 2019 Singapore IDC Market Customer Demand Distribution 44

Table 34 2019 Malaysia IDC Market Customer Demand Distribution 45

Table 35 2019 Thailand IDC Market Customer Demand Distribution 46

Table 36 2019 Southeast Asia IDC Market Customer Demand Distribution 47

Table 37 2019 Philippines IDC Market Customer Demand Distribution 47

Table 38 2019 Vietnam IDC Market Customer Demand Distribution 48

Table 39 2017 - 2019 Southeast Asia Internet Economy Scale (Unit: USD 100 million) 49

Table 40 Growth of Internet users in Southeast Asian countries (Unit: million) 49

Table 41 2019 Southeast Asia Internet Economy Composition 50

Table 42 2019 China Internet Enterprises’ Main Investment in Southeast Asia Market 51

Table 43 China Internet Enterprises’ Main Investment in Southeast Asia

Table 44 International Cloud Service Provider Southeast Data Center Distribution Status (Partial) 56

Table 45 2020 - 2022 Southeast Asia IDC Market Scale Forecast 58

Table 46 2020 - 2022 Singapore IDC Market Scale Forecast 59

Table 47 2020 - 2022 Malaysia IDC Market Scale Forecast 59

Table 48 2020 - 2022 Thailand IDC Market Scale Forecast 60

Table 49 2020 - 2022 Indonesia IDC Market Scale Forecast 61

Table 50 2020 - 2022 Philippines IDC Market Scale Forecast 61

Table 51 2020 - 2022 Vietnam IDC Market Scale Forecast 62

Table 52 2018 - 2020 Southeast Asia New Built Submarine Optical Fiber Cable Status 64

Table 53 Singapore IDC Market Comprehensive Risk Assessment 69

Table 54 Malaysia IDC Market Comprehensive Risk Assessment 70

Table 55 Thailand IDC Market Comprehensive Risk Assessment 70

Table 56 Indonesia IDC Market Comprehensive Risk Assessment 71

Table 57 Philippines IDC Market Comprehensive Risk Assessment 71

Table 58 Vietnam IDC Market Comprehensive Risk Assessment 72

Chapter 1 Southeast Asia IDC Industrial Development Environment AnalysisSection

Section 1 Southeast Asia IDC Industrial Development Basic Environment Analysis

I. Southeast Asia IDC Industry Development Economic Environment

1. Main Economic Development Indicators

From the perspective of global economic development, the economic development of Southeast Asia is at a medium level, and the overall GDP growth rate has increased by 5.6% compared with 2018. It is developing rapidly and is an important cluster of emerging economies. The political environment of various countries has become stable, the market has gradually opened up, and the demographic dividend has become increasingly prominent in recent years, thus Southeast Asia has become one of the most dynamic and potential regions in the world's economic development.

In 2019, the total GDP of the six countries of Southeast Asian was USD 3.03 trillion, a growth rate of 5.8%, accounting for 95.8% of the overall GDP of Southeast Asia, and it was the main driving force for the economic development of the region. Indonesia is the largest economy in Southeast Asia, with a total GDP of more than USD 1 trillion; the economic growth of the Philippines, Indonesia, and Thailand remained at a high level, with growth rates of 8.6%, 7.4% and 7.3% respectively; The overall economic development in Singapore and Malaysia is good, while the growth rate is relatively slow.

Table 1 2019 Southeast Asia Countries Main Economic Indicators

Country | Total GDP (USD 100 million) | Growth Rate | GDP per capita (USD) | Foreign Direct Investment (USD 100 million) |

Singapore | 3720.6 | -0.3% | 65233.3 | 920.8 |

Malaysia | 3647.0 | 1.7% | 11414.8 | 77.0 |

Thailand | 5436.5 | 7.3% | 7808.2 | 63.2 |

Indonesia | 11190.0 | 7.4% | 4135.6 | 235.6 |

Philippines | 3768.0 | 8.6% | 3485.1 | 76.5 |

Vietnam | 2619.2 | 6.8% | 2715.3 | 161.2 |

Data Source: June 2020, World Bank

Section 2 Southeast Asia IDC Industrial Development Basic Resource Environment Analysis

I. Southeast Asia IDC Industry Development Electric Resource Environment

In recent years, Southeast Asia, as a major emerging market, is developing rapidly. The progress of power infrastructure construction has accelerated. In addition to Singapore, Malaysia, Thailand, and Vietnam have also achieved full electric power grid coverage. Southeast Asian countries have maintained rapid growth in population and economy, and demand for power has a substantial increase. Because the overall power infrastructure has not yet been developed and perfected, there is a relatively large gap in power supply. Currently, Singapore and Malaysia, Indonesia and Malaysia, Indonesia and the Philippines, as well as Thailand and Laos and other countries beside the Mekong River have achieved electric power grid interconnection and interoperability on a partial scale.

Table 2 2019 Southeast Asia Main Countries Electric Power Resource Status

Country | Electric Connection Rate | Average Duration of System Interruption (Hours) | Electricity Access Level (1= most accessible) | Industrial Electricity Price (USD/KW) |

Singapore | 100.0% | 0.0 | 19 | 0.175 |

Malaysia | 100.0% | 0.7 | 4 | -- |

Thailand | 100.0% | 0.5 | -- | -- |

Indonesia | 98.5% | 4.0 | 33 | -- |

Philippines | 94.9% | 3.9 | 32 | 0.25 |

Vietnam | 100.0% | 3.9 | 27 | 0.039-0.197 |

Data Source: June 2020, World Bank

Chapter 2 Southeast Asia IDC Business Market Scale Analysis

Section 1 Southeast Asia Overall IDC Business Market Scale

Driven by a number of informatization policies in various countries and the Internet industry, the Southeast Asian IDC market maintained steady growth in 2019, with a market size of USD x billion. As the most important IDC market in Southeast Asia, Singapore market accounted for x%, followed by Malaysia and Indonesia, which account for x% and x% respectively. In recent years, the Singapore IDC market has become increasingly saturated, and the decline in its growth rate has led to a slowdown in the overall IDC market growth in Southeast Asia.

Table 3 2015-2019 Southeast Asia IDC Market Scale (Unit: 100 million)

Data Source: June 2020, KZ Consulting

Table 4 : 2019 Southeast Asia IDC Business Market Scale Country Distribution Status

Data Source: June 2020, KZ Consulting

Section 2 Southeast Asia Main Countries IDC Business Market Scale Analysis

I. Southeast Asia IDC Business Market Overall Distribution

Relying on steady political environment, mature business environment, developed Internet and solid electricity Infrastructure, Singapore has become an important deployment location and connection center for Southeast Asia and Asia Pacific business of international companies. Multiple International IDC Service Provider and Cloud Service Provider has operated here for years. In addition, Singapore is becoming another important node connecting the Chinese market to International Internet Companies, further enhancing the geographic importance of Singapore’s IDC market.

Compared with Singapore, the IDC market scale of other Southeast Asian countries is quite different. Driven by domestic demand, they are all in the rapid growth stage but different rate. Indonesian market has the fastest growth rate and the Malaysian market has grown slowly.

Copyright Instruction

The copyright of this report belongs to Zhongke Zhidao (Beijing) Technology Shareholding Company and its subsidiary KZ Consulting.

This report is the research and statistical results of KZ Consulting. The nature of it is business information for customers' internal reference, and the data and conclusions only represent views of the company.

This report is provided to the customer who has purchased and it is for internal use only. If the report purchaser wants to publicly reference the data and views in this report, they must submit a written application to KZ Consulting in advance. It could be publicly referenced with the written permission from the KZ Consulting. Report purchasers shall not publicly reference any data and views in the report by any means(including Internet)and shall not provide the report content to any organizations or individuals without the approval, confirmation and written permission from KZ Consulting. Otherwise, all the legal consequences caused by the customer shall be borne by the customer. Meanwhile, KZ Consulting (IDCquan Research Center) retain the right to pursue legal actions against the customer if they also believe that the behavior infringes the copyright of KZ Consulting (IDCquan Research Center).

KZ Consulting (IDCquan Research Center)

Zhongke Zhidao (Beijing) Technology Shareholding Company

For more abundant, comprehensive and detailed text content, chart and data, please contact us to purchase.

Contact Information

Email: [email protected]

Contact Number: +86 (10) 5166 8499